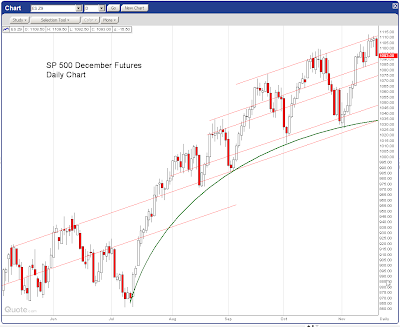

This chart says it all (thanks Jesse).

This chart says it all (thanks Jesse).

In last week’s wrap-up I said: “Since early September our upside targets for the indexes have been: Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623 and nothing has happened to change our fundamental outlook for the better so the closer we get to those levels, the LESS comfortable we are taking bullish positions.” I mentioned how tempting it had been to cash out all our longs and go 100% bearish when we hit 10,300. Our downside levels told us to wait until the 16th, when Monday’s move was finally the last straw and we are out of the bull game, probably for the rest of the year.

This chart shows you that the S&P is primed for a 5% correction back to 1,050. I don’t know why Jesse didn’t extend out the lower support line, which would take us right about to my pullback target of S&P 1,000/Dow 9,650. I stuck my neck out on TV two weeks ago, calling for a 10% correction to those levels but we’ve been playing both sides of the fence until this week, when I finally had to put my foot down on Monday, after having discussed cashing out for the holidays in Member Chat over the weekend. Our general plan this week was to cash out the winners and leave only longer-term, hedged bullish plays while adding more speculative downside plays for the short-term correction.

Why the change of heart? Well, something you don’t see on this chart but is pretty clear on the Yahoo monthly view, is that virtually all of the gains (ALL of them if you include the spikes) in the Dow for the ENTIRE month of November have come on single days each week. This week it was Monday (139 points), last week Monday (206 ponts) and Nov 5th was Wednesday (198 points). Take those days out of the run from our Oct 30th close at 9,712 and we’re up just 63 points to 9,975 despite there being only 1 losing day in the first week (11/3, down 16 points) of the month and one losing day in the second (Nov 12th, down 92 points). That is one super-flimsy way to build a “rally” don’t you think?

Why the change of heart? Well, something you don’t see on this chart but is pretty clear on the Yahoo monthly view, is that virtually all of the gains (ALL of them if you include the spikes) in the Dow for the ENTIRE month of November have come on single days each week. This week it was Monday (139 points), last week Monday (206 ponts) and Nov 5th was Wednesday (198 points). Take those days out of the run from our Oct 30th close at 9,712 and we’re up just 63 points to 9,975 despite there being only 1 losing day in the first week (11/3, down 16 points) of the month and one losing day in the second (Nov 12th, down 92 points). That is one super-flimsy way to build a “rally” don’t you think?

Getting 90% of our gains in on 3 days in 3 weeks indicates a certain lack of follow-through to these bullish market moves. I outlined the nature of the manipulation that takes place in yesterday’s post so I won’t get into it here but, in the words of our favorite economist, Elaine Benes,…