$712,800,000,0000.

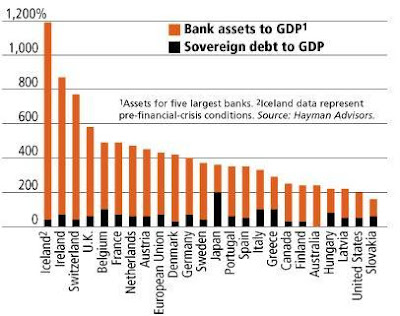

That’s how much the ECB dished out to 800 lenders this morning – close to $1Bn per bank of cheap, 3-year loans in the hopes that they, in turn, will turn around and lend them out to people and businesses throughout the EU at less-than-cheap rates so the EU banks can make a nice profit and back-fill the gaping holes in their balance sheets that have been devastated by defaults and currently are being ignored by the mutually assured distraction that allows everyone’s assets to be marked to fantasy.

As we saw yesterday, US foreclosures in Q4 were jumping at a rate of 100,000 per month – and that was before the settlement. There is a backlog of 4M homes in foreclosure in the US and Case-Shiller’s Home Price Index have hit record lows on the 20-city Composite Index. So it’s not just the $400Bn worth of losses on homes in foreclosure (4% of all homes) that have not been taken by the banks but the impuned damage of another $10Tn of asset devaluation on the other 96M homes that is being ignored by US banks.

Europe has more people and more homes and more unemployment than the US. While there is no convenient Case-Shiller report in the EU, we can reasonably expect that EU banks are at least as screwed as US banks and we’re not even discussing their Trillions of questionably-valued bond holdings

So, when you watch the markets today and wonder how it’s possible that a $712Bn injection of capital widely distributed throughout the European Banking System (exact details a guarded secret, of course) doesn’t do anything to boost the markets – that’s why.

I read the news today oh boy

Four thousand holes in Blackburn, Lancashire

And though the holes were rather small

They had to count them all

Now they know how many holes it takes to fill the Albert Hall.

Until we do an actual reconciliation of all the holes in all the banks around the World, we’ll never have…

Until we do an actual reconciliation of all the holes in all the banks around the World, we’ll never have…