S&P 1,260. That’s the line we need to hold.

S&P 1,260. That’s the line we need to hold.

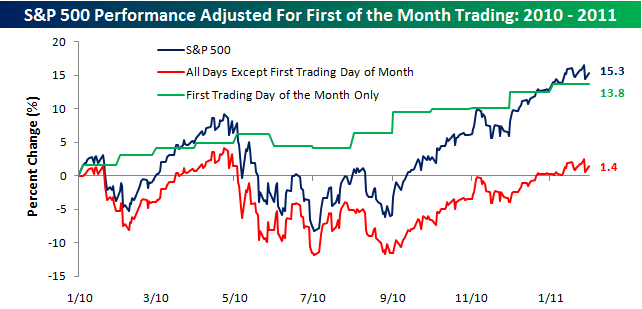

That’s where we started the Year on January 3rd and we finished that day at 1,271, beginning a fine tradition of making almost all of our gains on the first day of the month, continuing a very disturbing (and very fake) year-long trend that I am calling “sell the next day (of the month) and go away.” (chart by Bespoke).

Notice that this trend became very disturbing at the same time Uncle Ben announced his fabulous QE2 plan that showered money on his fellow Banksters according to a nice, predictable schedule that allowed them to lever up their investments to inflate stocks and commodities, trapping index fund investors (especially the working poor who make monthly contributions to IRA and 401K accounts in a nice, predictable and controllable fashion). It’s a simple plan, index fund managers get your pension money at the end of the month, they are required to buy baskets of stocks to balance their funds and that action can be manipulated by clever bankers who jack up the prices and then sell into the fake demand they created – effectively stealing tens of Billions each month out of the paychecks of working Americans. Just another one of those great crimes they commit where they steal a little bit of money from everyone, every day.

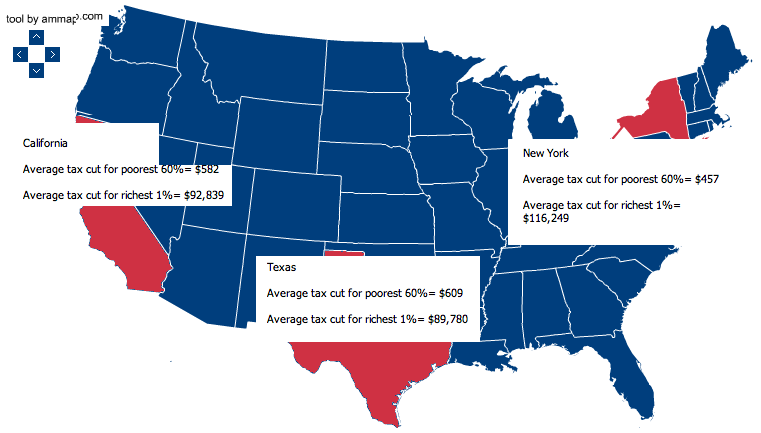

Speaking of robbing from the rich to give to the poor (see “The Dooh Nibor Economy“), it’s time we said happy 10th anniversary to the Bush/Obama tax cuts that have, as Barry Ritholtz put it: “driven the balanced budget he inherited from President Clinton deep into the red.” So deep in the red, in fact, that even now Congress is still debating about extending the $14.5Tn deficit that the Congressional Budget Office says will double over the next 10 years if these cuts remain in place.

Speaking of robbing from the rich to give to the poor (see “The Dooh Nibor Economy“), it’s time we said happy 10th anniversary to the Bush/Obama tax cuts that have, as Barry Ritholtz put it: “driven the balanced budget he inherited from President Clinton deep into the red.” So deep in the red, in fact, that even now Congress is still debating about extending the $14.5Tn deficit that the Congressional Budget Office says will double over the next 10 years if these cuts remain in place.

That’s right, those same tax cuts that are “off the table” in negotiations in Congress are, other than war spending, the sole cause of our nation’s deficit. This country does not have a spending problem, it has a collecting problem! As Mike Konczal, a research fellow at the Roosevelt Institute, noted: “It’s not like this has unleashed a wave of productivity, or better incentives, or increased work output. It’s mostly just rich people got a lot more money.”

According to Citizens for…

According to Citizens for…