No wrap-up this week as I updated the Buy List (and make sure you read the comments for bonus plays).

No wrap-up this week as I updated the Buy List (and make sure you read the comments for bonus plays).

I’ll do a nice, 2-week wrap up next weekend as we have the holiday. Monday, the 5th will be our last day off until Sept 6th so we’ll see if we’re in for Summer doldrums or a repeat of last summer, where the S&P ran from 879 on July 10th, to 1,068 on Sept 15th for a nice 21.5% gain in 2 months. Now we’re right back to test the top of last Summer’s rally and find out how real it really was – very exciting.

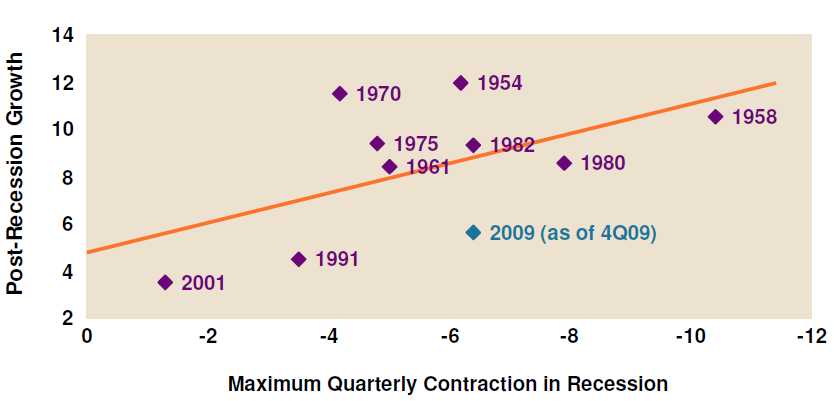

I very much liked Liz Ann Sonders’ take on the markets, she not only has a nice video presentation but there’s a slide show to go with it so kudos to Schwab for providing some very serious value to their clients. Liz has coincident indicators (#6) going up nicely and makes an excellent point about where we are in the norms of recessions past (#8 which is based on recessions between 1950-2010 and annualized Q/Q % change for real GDP. Post-recession growth represents maximum growth one year following recession end):

She points out that the yield spread makes it VERY unlikely we’ll be double-dipping (9), that payrolls were over-cut and are now a “coiled spring” (12) based on CEO optimism (10) but my concern is that CEOs are generally in the top 10%, where unemployment for that group is just 3% so it’s posible that they are as out of touch with reality as many people I speak to in the investing world and that may explain how CEO confidence can be over 60 (out of 100), while consumer confidence is at 35 (out of 200). If you look at that chart (10), you’ll notice CEOs do seem better at calling a bottom than consumers, who tend to be at their gloomiest just when a recession is ending.

Forget Spain and Greece by the way, they have a grand total of $209Bn in debt but Italy owes $208Bn TO FRANCE! They also owe $210Bn to other countries but WHAT THE HELL WAS FRANCE THINKING? Italians are striking this week to protest Berlusconi’s $34Bn of austerity cuts, which include pay freezes or salary cuts for all government workers and reductions in funds for health care and local governments.

Forget Spain and Greece by the way, they have a grand total of $209Bn in debt but Italy owes $208Bn TO FRANCE! They also owe $210Bn to other countries but WHAT THE HELL WAS FRANCE THINKING? Italians are striking this week to protest Berlusconi’s $34Bn of austerity cuts, which include pay freezes or salary cuts for all government workers and reductions in funds for health care and local governments.

The government has warned Italians to get ready to make “heavy sacrifices” to avoid a Greek-style financial crisis. My favorite report on this comes from our friends at Fox News…