Weekend Thoughts

I am starting to find more charts which looks bearish as bullish and in fact very many of them, with-in that need to turn of cource for bigger index products like SPX500 stocks.

In short term I think this market is starting to run out of gas at least for corrective letters. Does not concern all the charts but after 2 months good rally (outside of SPX components) I think january buying power starts to be over.

If one is investor rather than any trader my opinion is one should come out from there for some time. The risk is increasing.

Many of the charts are also bullish, I have stocks which are doubled and even tripled now in less than 2 months, after such an upmovement any correction should not be surprize.

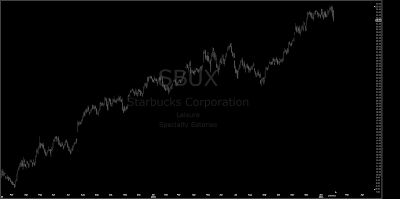

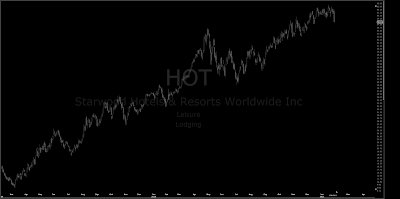

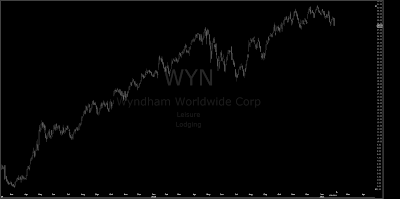

However, looking for instance these SPX charts below, it is very simple view they are offering, each of them have 5 allready up and friday first sizable negative session for decades might suggest that 5 up is done now.

This is propability area, I don´t think probs are very good for entire market in here anymore.

I will find bullish setups also (still not from SPX) , but this is new.

Now-on I will find also bearish charts and lot of them. I am planning to enter for sell & short side.