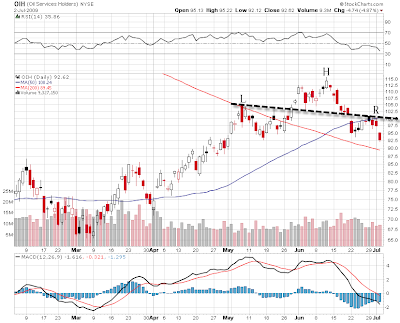

Looks pretty beautifull set for me as HS pattern and those open wide falling oscillators won´t leave so many open questions either. Should travell for .618 also. Seems that market is full of HS patterns again everywhere for July.

I suppose with this daily chart there´s not so much need to look alternate triple zigzag scenario anymore for eurodollar either instead correction directly to the 1.3500 area as C wave. After all, it´s still repairing it´s corrective picture since bear wedge. Very unusual actually, usually wedge patterns drops ABC pretty quickly while eurodollar gave only A at so far and everything since has been B upwave , but C is missing. This very long lasting “B” wave which I had been trading recent weeks broke for full “wxy” scenario and it makes me wonder can B wave actually do this because it looks alike more as W2 instead B.

However, in shorter timeframe waves, it might need to retrace first C/2 and I don´t think my last long overnight longs gave enough yet to finished it.

After all, there´s no much secret behind the idea that oil is under correction mode, recent peak 147 $ 50% fibonacci correction top was set under 75 $ and there´s no access above before serious correction at least is over. 61.8% will be buy also for Oil later. After HS pattern is ready, it´s actually bullish again.