Simple MacroEconomy;

Every time market see upcoming inflation, we have big rally with commodites (and stocks follows those).

Every time market see upcoming easing with potential inflation, we land with commodities (and stocks follows again).

Ie.

The market risk is ON or OFF depending which way market thinks about inflation.

24 hours ago we did switch for “risk is ON” mode when CRB index cracked over -3% percent after “who knows” how many months parabolic highfly rise following chinese market crack because of inflation easing fears. US market took it very well actually, giving back only percent and half which was second minus day for last 10 weeks now. The world new rally record since 1937.

Irish was of cource another factor but far much less.

Movements starts in these days from Asian market and it seems currencies have tendecy to lead it a bit – a few days ahead, allmost like microeconomy would be running after macroeconomy – not as vica verca.

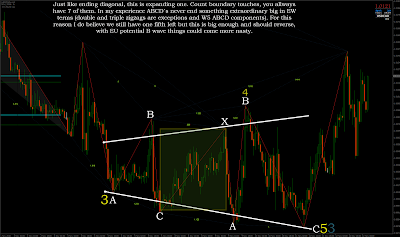

It is daily chart double bottom for UsaCad, but also some kind of expanding triangle or then expanding ending diagonal with smaller TF – not my favorite one but I assume this will respond some more.

Eur-Usd is retraced 38.2% as most typical A wave area at so far, not much yet actually but any B wave for it could bring things a bit more nasty again. This UsaCad chart is also ABCD bullish with daily chart with this bottom, twice in fact. My experience is that ABCD is not most agressive setup available the way it is in here (it is not something like W2 for instance or anything like that, with W5 or double and triple zigzags it is better combo pattern) but this likely will respond some, it is also EW channel bottom and double bottom also for daily chart.

SPX reached also daily chart 161.8% expansion week ago which was slightly overlapped for 178.6% where reversal took the place. In EW these things tend to end many scenarios, not only one degree W3´s but also many C and Y waves.

Not very good odds now available for bullish markets with these cirmunstances to start next week but this all you knew allready week ago so I assume there is no surprizes. If someone asks my opinion, let it land – only that way I could get also smaller degree bullish patterns again.

2 or 3 minus days only and it is allmost 3 months time passed, amazing market – you got to love it.