The Commitments of Traders (COT) Report is released by the Commodity Futures Trading Commission (CFTC) every Friday afternoon. This report contains useful information about the positions of various participants in the futures markets. It can be found on the CFTC’s web site at www.cftc.gov.

The COT reports provide a breakdown of each Tuesday’s open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. The report gives you is the market activity of three main groups active in the futures markets–the commercials, which are generally the end-users or producers of commodities, such as farmers or refiners. These are typically hedgers. Large traders are the bigger speculators, consisting of participants including commodity funds, hedge funds, banks and other institutions. Small traders are the small speculators.

The COT report is useful to you as an individual trader because it tells you what the biggest and most highly capitalized players are doing in the market, the so-called “smart money.” In general, you want to watch for changes in how this group is positioned so you can get clues as to possible market shifts in trend.

In the agricultural markets, I have found prices may not move as closely in the direction of the commercial participants, because they are typically hedging future production or consumption. These players don’t care as much about market movement from day-to-day; they are using longer-dated futures contracts to lock in prices for future delivery of physical goods.

In the metals, energy and the stock index futures, where physical delivery of the contracts is not as a big a factor, individual traders can use the COT report to position for a bigger move by staying on the right side of the larger commercial participants. Let’s look at last week’s report, released on August 17, 2009, for gold, silver and the S&P 500 futures.

Gold

In the latest COT report, the commercial traders were net short 222,000 futures contracts. They had reduced their net short position by 5,200 contracts from the previous week, but that’s still a pretty large net short position. The non-commercials were long about 190,000 contracts and non-reportables, or the small speculators, were long about 32,000 contracts.

You can see how the commercial positions were established over the past few weeks on the chart of gold in anticipation of a break. If you had decided to get short the gold market after Friday’s close based on this report, you would have caught the move lower on Monday, August 17. COMEX December gold futures saw a breakout to the downside on Monday, falling $12.90 an ounce to $935.80.

On a technical basis, it looks as if the prior uptrend has been broken. There is some support near $930 an ounce, but if the market breaks under $930, the market could fall to $910 or $900 over the next couple weeks. I would look at the COT reports in following weeks to see if there are large net changes in the commercial group.

In silver, the commercials were net short 42,000 contracts, compared with 27,000 for non-commercials. On Monday, COMEX September silver futures fell to close under $14 an ounce, the lowest in two months. Based on the large size of the commercial short position, and the added shorts last week, I think silver will continue to move lower. This market could see $13.20 and even $12.60 as the U.S. dollar continues to get stronger.

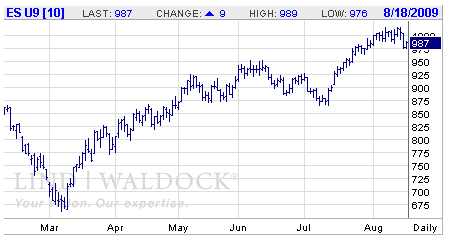

S&P 500

The E-mini S&P 500 futures saw the biggest net change in the latest COT report compared with the prior week. Commercials were short 82,000, with a change for the week of 96,000 contracts. In the week prior, the commercials had a long position of 14,000 contracts and therefore we saw a big shift to the short side. Looking at the full-sized S&P 500 futures contract, commercials also showed a net short position of 29,000 contracts. The non-commercials were net short 13,000 contracts, while the small speculators had a net long position of 44,000. With the large amount of open interest held by small speculators, I think that means we’ll continue to see a sell-off in the next few weeks as these participants may be forced to liquidate positions.

From a technical standpoint, the September S&P contract should test 950 and beyond that, 870. The 200-day moving average comes in at 869, and I would not be surprised to see a correction to that level. I think the market should bottom toward end of September or October, typically a bearish time of the year. At that point, I think the market should start to rally into 2011.

Based on what I see in the COT reports, at this stage I think the best way to play these markets is to sell rallies. Feel free to contact me with any questions you have about interpreting the COT report for these or other markets, and to develop a customized trading strategy for your particular situation.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which

Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

Matt Roma is a Senior Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division. He can be reached at 866-231-7811 or via email at mroma@lind-waldock.com.

You can hear market commentary from Lind-Waldock market strategists through our weekly Lind Plus Markets on the Move webinars . These interactive, live webinars are free to attend. Lind-Waldock also offers other educational resources to help your learn more about futures trading, including free simulated trading. Visit www.lind-waldock.com.

Futures trading involves substantial risk of loss and may not be suitable for all investors. © 2009 MF Global Ltd. All Rights Reserved. Futures Brokers , Commodity Brokers and Online Futures Trading . 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604.