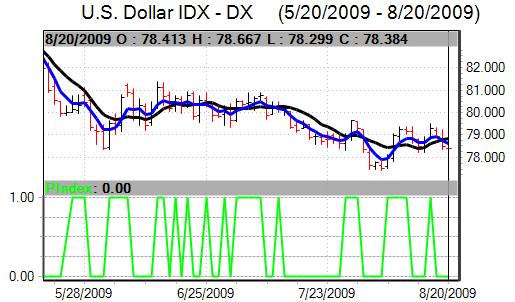

Markets continued to struggle for direction over the week. The dollar pushed higher over the first half of the week, but again struggled to make any significant headway and came under renewed selling pressure. Defensive demand for the dollar faded during the week as equity markets attempted to rally while underlying confidence in the currency remained weak.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The US New York Empire manufacturing index strengthened to 12.1 in August from -0.6 the previous month which provided some degree of reassurance over the manufacturing sector. The Philadelphia Fed index also improved to 4.2 from -7.5 the previous month, maintaining the positive tone.

In contrast, the jobless claims data was weaker than expected with initial claims rising to 576,000 from a revised 561,000 the previous month while continuing claims also increased. The jobless data does lag behind the economy as a whole and the manufacturing data has been firmer, but there were fears that the economy will stall quickly under the weight of credit contraction and consumer debt levels.

The construction-related data was slightly weaker than expected with housing starts edging slightly lower to an annual rate of 0.58mn from 0.59mn the previous month while permits were also slightly lower at 0.56mn. The headline data was held back by notable weakness in the multiple-units sector while there was still evidence of an underlying improvement in conditions.

The latest US Treasury capital flows data recorded net long-term inflows of US$90.7bn for June after revised net outflows of US$19.4bn the previous month. Overall capital flows were still negative for the month and monthly data will inevitably be volatile. There was strong buying of US Treasuries for the month which may ease fears over reserve diversification to some extent, although there was a decline in Chinese holdings over the month.

The Euro was unsettled temporarily by a sharp drop in Chinese equity prices which undermined international risk appetite while there was also a sharp fall in German producer prices which reinforced speculation over deflation pressures.

The German ZEW business sentiment index rose to 56.1 in August from 39.5, the highest headline reading for over two years, although ZEW officials were cautious over the outlook due to the underlying vulnerabilities. There were also further concerns over the threat of a credit crunch developing over the next few months which limited any positive Euro impact.

The Euro resisted more than limited selling pressure during the week and was able to secure modest advance as global risk appetite improved from initial lows. The Euro consolidated just above 1.42 against the dollar.

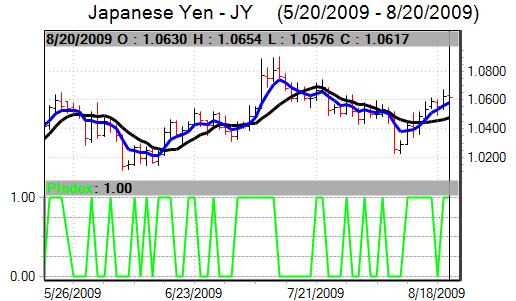

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The yen strengthened against the US dollar over the week and tested US currency support levels below the 94 level. The Japanese currency was broadly resilient on the crosses and firmed towards 93.50 on Friday. Commodity currencies were volatile with a slightly weaker underlying tone.

The UK retail sales data was marginally stronger than expected with a 0.4% monthly increase for July after a revised 1.3% increase the previous month. The Rightmove index recorded a 2.2% decline in house prices for August, breaking the recent run of favourable economic data, although the series can be prone to seasonal volatility.

The government borrowing data was substantially worse than expected with a GBP8.0bn monthly deficit for July. For the first 4 months of the fiscal year, the borrowing requirement rose to GBP49.8bn from GBP15.8bn. The borrowing data will reinforce underlying fears over the debt position and will provide a stern test of market confidence in the UK economy and currency.

The latest consumer inflation data was higher than expected with the annual rate unchanged at 1.8% compared with expectations of a decline to 1.5% while there was a 1.4% annual decline in the RPI index with housing costs still showing a substantial annual decline. The higher than expected inflation rate initially dampened expectations of more aggressive Bank of England monetary policies.

The Bank of England minutes recorded a 9-0 vote for unchanged interest rates at the August policy meeting. There was a 6-3 vote in favour of the GBP50bn expansion of the quantitative easing. The dissenters wanted a larger GBP75bn increase in the programme, in contrast to expectations that members voting against were more likely to want a pause in the bond buying scheme. The pressure for a more aggressive quantitative policy undermined Sterling.

Sterling was subjected to sharp selling pressure at times, but was able to resist heavy losses for the week as a whole with some buying support below 1.64 against the US dollar. Trends in risk appetite continued to have an important influence as selling pressure on Sterling intensified when equity markets fell sharply. In contrast, the recovery in risk appetite helped the UK currency rally.

The dollar was unable to sustain a move above 1.08 against the Swiss franc during the week and weakened back towards 1.06 later in the week on wider losses for the currency. The franc moved stronger against the Euro.

Swiss National Bank member Jordan stated that bank would not tolerate a rise in the franc against the Euro and that the bank will maintain the policy of unconventional easing in the short term.

Jordan’s comments were particularly blunt for a central bank official as pledged that the franc would not be allowed to strengthen through the 1.50 level against the Euro.