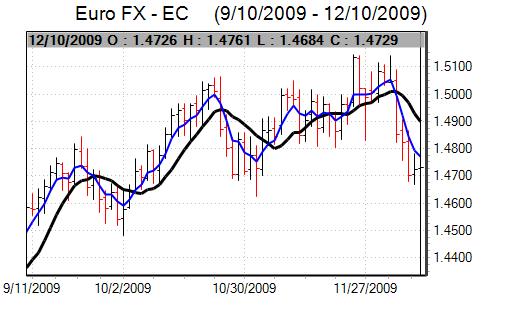

There was a greater focus on the Euro during the week which helped support the US currency as it tested one-month highs against the Euro before stalling.

The Euro was undermined significantly by a Fitch downgrading of the Greek sovereign credit rating to BBB+ from A and there was also a negative outlook for the rating. There was a further widening of Greek bond spreads over German bunds. Standard & Poor’s also put Spain’s credit rating on negative watch from stable previously due to fears over the debt situation.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Bundesbank head Weber warned that Greek bonds would not be eligible to be used as collateral for ECB funds from the end of 2010 when the temporary reductions in eligibility criteria are due to end.

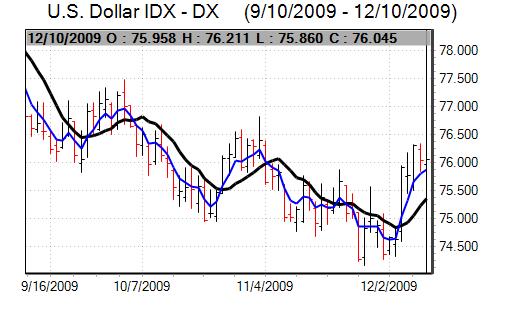

Initial US jobless claims were higher than expected at 474,000 in the latest week from 457,000 previously, but there was a further decline in continuing claims which maintained some degree of optimism over a gradual labour-market improvement. The retail sales data was firmer than expected with a 1.3% monthly increase for November.

The trade deficit was lower than expected with a US$32.9bn shortfall for October after a revised US$35.7bn deficit the previous month and the dollar will take some limited comfort from a rise in capital goods exports which suggested a firm competitive position.

In comments to the Washington press club, Fed Chairman Bernanke was generally cautious over the outlook for the US economy, warning that there were still important headwinds and that there were still doubts over the scope for a self-sustaining recover. The Fed chief also repeated comments that interest rates would remain at very low levels for an extended period. The comments were important in dampening the yield-based dollar rally seen on Friday following the November payroll report.

After falling sharply at the end of last week following the US payroll data, the Japanese yen recovered ground as doubts over the global economy continued. There was also evidence of exporter selling at levels above the 90 level with dollar support below 87.50.

The third-quarter Japanese data was revised sharply lower to record a 0.3% increase compared with the previous 0.8% figure while the GDP price deflator was also revised sharply lower which will reinforce deflation fears. The data will maintain pressure for additional support measures from the Bank of Japan and maintain fears over the economic outlook.

Sterling remained under pressure during the week as government debt fears persisted, although the degree of selling slowed later in the week with Sterling finding support below 1.62 against the dollar.

In the pre-budget report, the government announced a slightly higher budget deficit forecast for the current fiscal year of GBP178bn with very little change for next year with a deficit of GBP176bn.

There was a proposed tax on banking-sector bonuses, but little in the way of fresh measures to curb near-term borrowing levels, although labour-market taxes were raised slightly from 2011. There were increased fears that no significant action would be taken before the general election which must be held by June 2010.

In this environment, there is a high risk that market confidence in the debt situation will deteriorate further and there was speculation that there could be a very serious loss of confidence which could trigger heavy Sterling selling. There was renewed selling pressure following the report, but Sterling again found support below 1.62 against the dollar.

The central bank policy was in line with expectations with interest rates held at 0.50% while the amount of quantitative easing was also left on hold at GBP200bn. The bank expects that the bond-buying programme will be completed in 2 months and that it would reassess the situation then.

The dollar strengthened against the Swiss franc during the week, but hit tough resistance close to the 1.03 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

In its quarterly monetary policy decision, the National Bank left interest rates at 0.25%, in line with expectations. The bank also maintained its policy of intervention to prevent franc appreciation while corporate bond purchases were scaled back. This represented a gradual move towards a more normal policy, but interest rates were expected to remain at very low levels over the next few months.