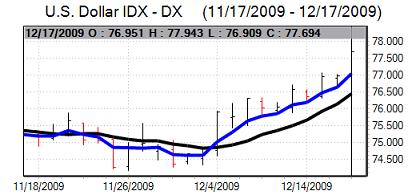

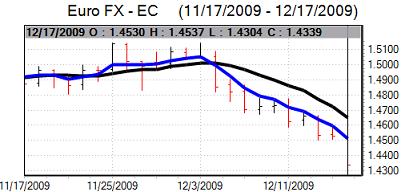

The Euro came under substantial selling pressure during the week with sharp losses against the dollar while it also lost significant ground on the major crosses as structural fears increased. There was initial stop-loss selling once the Euro weakened through the 1.45 level and a further round of selling once the 1.4450 area also broke with the dollar strengthening to a three-month high near 1.43.

There were warnings from the ECB that Greece needed to take steps to restore its sovereign credit rating by the end of 2010 when collateral requirements will return to pre-crisis levels. Difficulties within the Austrian banking sector triggered a renewed loss of confidence in the Euro as the government injected funds and effectively nationalised the fourth-largest bank.

The Euro weakened further on Thursday with Standard & Poor’s suggesting that a review of European covered bonds could lead to a downgrading of ratings on the bonds. There was also another Credit rating downgrade for Greece with Standard & Poor’s matching the downgrade by Fitch seen last week. These developments reinforced a mood of pessimism towards the Euro-zone economy and financial sector.

The US capital flows data was weaker than expected with net long-term inflows of US$20.7bn for October after inflows of US$40.7bn previously while there were small total net outflows. The data overall had a slight negative underlying dollar impact.

The US growth indicators were mixed. There was a stronger than expected reading for industrial production with a 0.8% monthly increase for November. In contrast, the NAHB index weakened to 16 for the month from a figure of 17 the previous month. Jobless claims rose to 480,000 in the latest week from a revised 473,000 the previous week which was slightly worse than expected.

There was a sharp decline in the New York manufacturing index to 2.6 for December from 23.5 which maintained some fears over the sector even though the series is volatile on a monthly basis. In contrast, the Philadelphia Fed index was stronger than expected with a rise to 20.4 from 16.7 the previous month. The index components were mixed with a deterioration in orders offset by a firmer employment reading.

There was a sharper increase in producer prices of 1.8% for November after a 0.3% the previous month while there was a 0.6% core increase. Consumer prices rose 0.4% for November while core prices were unchanged which provided some degree of optimism that inflation trends are still contained. The low point for inflation has, however, certainly been passed and the Fed will need to be on alert with the annual rate rising to 1.8% from -0.2% previously.

There were no surprises from the Federal Reserve on interest rates with the benchmark Fed funds rate left in the 0.0 – 0.25% range while there was also no change in the discount rate after some speculation over a possible move.

The Fed also maintained its references to interest rates remaining at low levels for an extended period. The statement was, however, slightly more optimistic on the economic outlook and also referred to capacity use being higher while the quantitative easing programme would be wound down from February 2010.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The dollar made some headway against the yen during the week, but continued to hit selling pressure above the 90 level against the Japanese currency.

The headline Japanese Tankan business sentiment index recorded an improvement to -24 for the latest quarter from -33 previously which was slightly better than expected. Smaller companies were less confident over a rebound in the economy and there were notably weak readings for capital spending with expectations that the decline in investment would be over 40% for the current fiscal year. The capital spending expectations maintained pressure for yen gains to be resisted.

The Bank of Japan held interest rates at 0.1% and there were no new quantitative easing measures, but the bank warned that it would not tolerate deflation.

The dollar pushed significantly higher against the franc during the week with a high above the 1.05 level. The Euro gradually declined against the franc and a break of the 1.50 support level triggered stop-loss Euro selling. There was no evidence of National Bank intervention, but markets remained on high alert.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Sterling weakened against the dollar, but did show some underlying resilience with support below 1.61. In this context, the UK currency did advance against the Euro as the UK currency continue to secure some support from a lack of confidence in the Euro-zone economy.

The latest UK consumer inflation data recorded an increase in the headline rate to 1.9% from 1.5% which was marginally above expectations. Although the impact was limited, there will be increased speculation over a significantly higher rate over the next few months and this will maintain pressure for an early policy tightening by the Bank of England. There will certainly be pressure for the quantitative easing programme to be suspended.

The unemployment data was again stronger than expected with a decline in the claimant count of 6,300 for November while the previous month’s data was also revised stronger and this was the first decline in the claimant count for over two years. Although the ILO data was slightly weaker. the data will increase speculation that there will be a move away from quantitative easing in February.

The latest UK retail sales data was weaker than expected with a 0.3% monthly decline for November, the weakest figure since June, which contributed to some further downward pressure on Sterling. The latest CBI retail survey was still optimistic over December sales, but there were expectations of a significant slowdown early in 2010 which had a neutral impact.