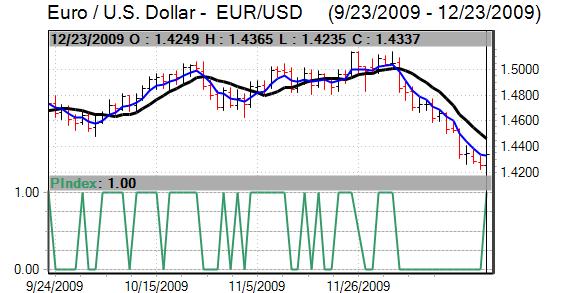

There was a continuing shift in trading patterns during the week with moves linked much closely to trends in yields. The dollar maintained a firm tone during the week and moved to a three-month high against the Euro with solid gains on a trade-weighted basis as well. There was a further reduction in short speculative positions, but the dollar lost momentum later in the week.

The US existing home sales data was stronger than expected with a rise in the annualised selling rate to 6.54mn for November from 6.09mn the previous month and this was the fastest selling rate since February 2007.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

In contrast, new home sales dipped sharply over the month. Third-quarter GDP was revised down to an annual rate of 2.2% from 2.8% previously while the latest Richmond Fed index returned to negative territory which reinforced the mixed picture surrounding the economy.

There were again comments from Central bank of China officials that the dollar is likely to depreciate in the medium term. These comments did not have a significant impact today, but could still be an important negative factor for the currency over the longer term.

Euro recoveries soon attracted selling interest during the week with Moody’s downgrade of Greece’s credit rating contributing to the negative mood even though the downgrading was less severe than feared by the markets. The Euro weakened to three-month lows against the dollar and was subdued on the crosses.

There was a decline in German consumer confidence for the third consecutive month. The IFO institute warned that credit availability for German companies had tightened in December compared with the previous month which will maintain fears over current recovery’s durability.

There was some further speculation that the ECB will be forced to delay monetary tightening during 2010 in order to protect the weaker Euro-zone economies from further stresses and help protect the banking sector.

The yen lost ground during the week with the US currency gaining some support on yield grounds and the US currency strengthened to a 7-week high close to the 92 level. The yen was still broadly resilient against the European currencies.

Sterling tended to drift weaker over the past few days with the currency still unsettled by an underlying lack of confidence. Sterling weakened to a two-month low against the US dollar with lows near 1.59 and also lost some degree of ground against the Euro, although it remained stronger than the 0.90m level.

Third-quarter GDP was revised higher to a figure of -0.2% from the -0.3% estimate previously, but this was weaker than expected with some speculation that there could be a figure of zero or better and the data had a small negative Sterling impact.

The Bank of England minutes recorded a 9-0 vote to leave interest rates on hold and to maintain the level of quantitative easing at GBP200bn.

There will be further unease over the UK government debt position as markets will speculate over trends during 2010 and attempt to differentiate between national risks. There will be continuing fears that there will be no policy adjustment during the first half of the year which will maintain the serious threat that there will be a loss of international confidence in the UK currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

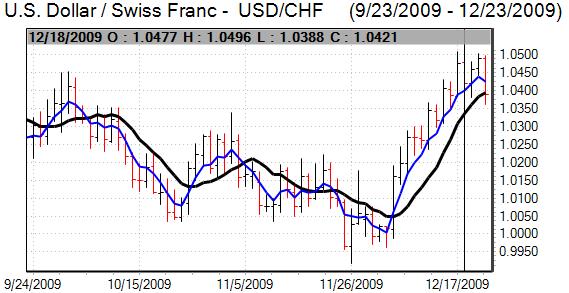

The US currency strengthened to a high around 1.05 against the Swiss franc with reports that the BIS was buying dollars against the Swiss currency. As usual, the National Bank declined to comment on the rumours.

A lack of confidence in the Euro-zone financial sector contributed to a firmer Swiss currency during the week.