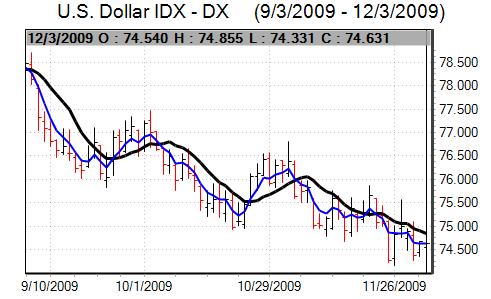

The dollar came under pressure for much of the week as the defensive demand seen last week surrounding the Dubai debt situation faded. There was support near the 2009 lows against the Euro and the dollar gained some defensive support as confidence in the global rebound faded slightly. There was a fresh bout of volatility on Friday following the employment report.

The latest US ADP employment report recorded net private-sector losses of 169,000 for November from a revised 195,000 decline the previous month and this continued to suggest a gradual improvement in the labour market. The latest Challenger survey also recorded a sharp decline in major job cuts from last year.

There was a further 3.7% increase in pending home sales for October following a revised 6.0% increase the previous month. In contrast, the manufacturing PMI index weakened to 53.6 for November from 55.7 previously.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The ISM index for the services sector was weaker than expected with a drop to 48.7 for November from 50.6 the previous month with a renewed decline to below the 50 level after only two months. The orders component was above 50 which will help cushion the impact, but the employment component remained very weak at 41.6.

The latest jobless claims data was again stronger than expected with a decline to 457,000 in the latest week from 462,000 previously which maintained some hopes of an improved non-farm payroll reading for Friday as the four-week moving average fell to a fresh 12-month low.

The Fed’s Beige Book stated that most districts reported an improvement in conditions during the latest survey period with consumer spending slightly higher. The commercial real-estate market was still deteriorating while loan conditions were still being tightened. The data reinforced expectations that any economic recovery will be subdued at best given the underlying pressures.

In congressional testimony on Thursday, Fed Chairman Bernanke made reference to gradual exit strategies and a withdrawal of liquidity measures, but there was no suggestion that interest rates would be increased in the short term. There were also no strong mention of the dollar in his remarks.

As expected, interest rates were left unchanged at 1.00% following the latest council meeting. The ECB announced that the long-term 12-month liquidity tenders would cease in December while the shorter-term programmes would continue into 2010.

There were mixed comments from bank President Trichet, although the overall tone of his comments was slightly more dovish than expected and the Euro failed to hold initial gains with fears that the economy would not be able to achieve a self-sustaining recovery during 2010.

In comments on Wednesday, Euro-group head Juncker stated that the Euro was overvalued which will create some caution over currency buying.

There was a firm reading for German retail sales while the unemployment data was also stronger than expected with a monthly decline supported by government fiscal measures. There was a small upward revision to the Euro-zone PMI manufacturing data, although there was also important signs of divergence as conditions in Spain and Greece deteriorated.

In the event, US job losses for November were much lower than expected at 11,000 from a revised 111,000 the previous month and, after initial losses, the dollar tested Euro support levels below 1.50.

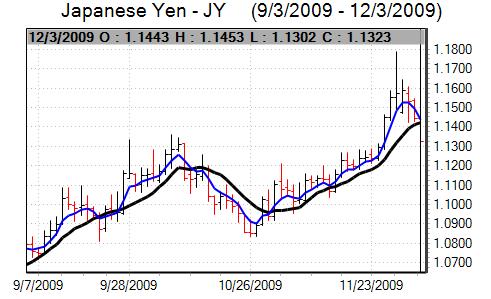

The Japanese yen remained strong at the start of the week, but was unable to break through the 85 level and was then subjected to a sharp reversal.

The yen weakened sharply in Asian trading on Tuesday as the Bank of Japan announced an unscheduled policy meeting. There was speculation that the bank would announce additional easing measures to help ease the deflation threat with the potential for additional quantitative easing.

The yen weakened to lows near 87.50 against the dollar before recovering back to 86.80 as the bank announced a new 3-month lending facility. Markets were sceptical that the measures would have a substantial impact.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Finance Minister Fujii stated that he had not ruled out intervention. There were comments from the Prime Minister that yen strength needed to be tackled and underlying pressure for yen gains to be resisted increased during the week. Following the US employment data, the dollar strengthened to above 89 against the yen while the dollar also found support below parity against the Swiss franc.

Sterling continued to be subjected to choppy trading conditions as bargain hunting was offset by underlying fundamental fears. There was selling pressure above 1.67 against the dollar, although it did rebound from levels below 1.65.

There was further unease over the UK credit-rating outlook with fears over the government debt outlook compounded by fears that the stresses surrounding Dubai debt will trigger a reassessment of sovereign ratings and further damage confidence in the UK currency. These fears gradually eased during the week.

The latest PMI manufacturing report was significantly weaker than expected with a decline to 51.8 for November from a revised 53.4. The construction PMI index also remained below the 50 level for November at 47.0, maintaining the 3-year contraction within the sector.

The services-sector index weakened to 56.6 from 57.1 the previous month. The initial impact was limited as it was still comfortably above the 50 threshold.

The UK lending data remained weak with a further contraction in consumer credit. Indeed, there was the sharpest decline on record for credit which will also maintain fears over the spending outlook and the economy as a whole.