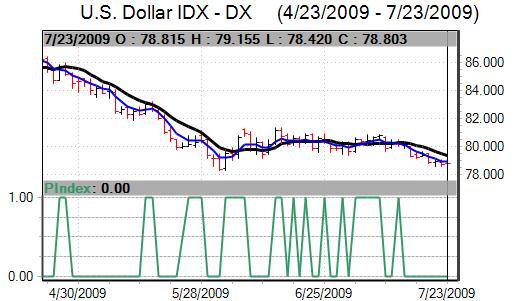

Currency markets generally have been trapped within relatively narrow ranges over the past few weeks. In this environment, institutional investors looked to target a breakout and secure a substantial move. The US currency was still found support at lower levels and recovered from an intra-week trough.

In his semi-annual testimony to Congress, Fed Chairman Bernanke stated that there were tentative signs of stabilisation in the economy and that the pace of decline appeared to have slowed significantly. Bernanke also re-iterated that the bank did have a credible exit strategy from the ultra-loose interest rate policy. The bank is clearly taken this aspect of policy very seriously, especially as there was a Wall Street Journal article on exit strategies ahead of the Fed testimony.

These comments illustrated that the Fed is very sensitive to the issue of maintaining confidence in the US assets, particularly the Treasury market and dollar. Nevertheless, Bernanke also stated that the Fed would maintain a highly accommodative monetary policy for an extended period and there is very little chance of a near-term tightening.

The latest US initial jobless claims data was close to expectations with an increase to 554,000 for the week after a revised 524,000 the previous week while the continuing claims data was better than expected.

The existing home sales data recorded a slightly larger than expected monthly increase to 4.89mn for June from a revised 4.72mn the previous month. Prices were higher over the month while inventories also declined for the month which provided some degree of reassurance over the housing-sector trends, although sales were still at historically very subdued levels.

The latest US house-price data also recorded a 0.9% monthly increase for May which cut the annual decline to 5.9% and provided some degree of support for risk appetite. There was fresh speculation that US lender CIT would file for bankruptcy despite securing a US$3.0bn credit line while the corporate earnings reports were mixed with an overall firm bias.

The Euro-zone economic data was weaker than expected with a further small monthly decline in industrial orders to give a 30% annual decline. In contrast, the PMI data recorded a further improvement for July while the German IFO index strengthened to 87.3 for the month from 85.9 the previous month.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Euro again struggled to sustain advances higher and consolidated in the 1.42 region against the US currency with a mixed Euro trend on the crosses.

The Japanese currency was unable to strengthen through the 93 level against the dollar and, although it proved resilient for much of the time, there was selling pressure late in the week. There were also rumours that a key fund was set to buy the dollar on any dips to the 93 level and the dollar challenged levels above 95.0.

The latest Japanese trade data recorded a slightly smaller than expected surplus for June with the export data a principal focus. There was a 35.7% annual decline with a 1.1% monthly increase in shipments which provided some degree of relief.

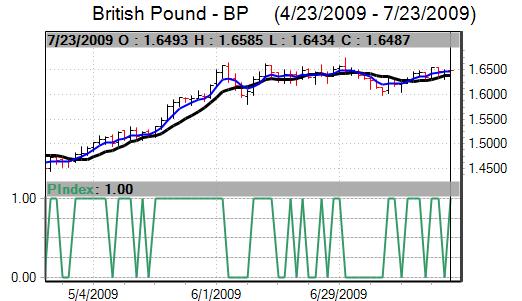

The UK currency was undermined temporarily by reports that the banking sector would require further capital and by a gloomy assessment of medium-term prospects by the NIESR institute, although it still proved to be generally resilient.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The latest government borrowing data provided some degree of initial relief with a figure of GBP13bn for June after a revised GBP18.6bn the previous month and compared with expectations of a GBP16bn shortfall. This was still sharply higher than the GBP7.5bn recorded the previous year and overall debt fears will remain an important issue as the budget deficit is heading towards 14% of GDP for this year.

The headline UK retail sales data was stronger than expected with a 1.2% increase for June after a revised 0.9% decline the previous month as sales were boosted by favourable weather conditions and discounting.

There was also an increase in BBA mortgage approvals according to the latest data with approvals at a 15-month high and this helped maintain the mood of greater confidence towards the UK housing sector which also underpinned risk appetite.

Bank of England MPC member Sentance stated that the bank may pause the quantitative easing process, although there was also still a high degree of uncertainty over the situation. Deputy Governor Bean stated that second-quarter GDP was also certainly negative. In the event, there was a further 0.8% contraction for the quarter compared with expectations of a 0.3% decline.

The Bank of England recording a 9-0 vote for unchanged interest rates and no changes to the GBP125bn quantitative easing programme with a review scheduled at the August meeting. The bank was slightly less pessimistic over near-term economic prospects which underpinned the currency to some extent.

Sterling tested resistance levels above 1.65 against the US dollar before weakening after the GDP data.