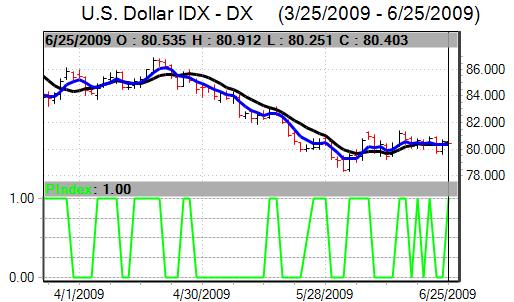

The dollar weakened against the major European currencies over the first half of the week. Although it was able to resist substantial losses, the dollar struggled to sustain any momentum and dipped again on Friday. Markets still found it difficult to secure a decisive trend given underlying uncertainties with commodity-price trends important.

The US currency was again dogged by underlying speculation over medium-term central policies to diversify away from the dollar, especially with further negative comments from the Bank of China.

The US data was mixed over the week as a whole. The durable goods orders data was stronger than expected with a second successive 1.8% monthly increase. In contrast, there was a weaker than expected figure for new home sales with a slight decline to an annual rate of 342,000 in May from 344,000 previously.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Existing home sales rose to an annual rate of 4.77mn for May from 4.66mn previously which was also slightly below expectations. Prices were slightly higher over the month while inventories were lower which will provide some underlying support to optimism that the sector is bottoming out.

Jobless claims rose to 627,000 in the latest week from a revised 612,000 previously while continuing claims rose to near 6.74mn. The claims data has been showing signs of improvement and the latest release will cause some fresh anxiety over the labour-market situation, although there will inevitably be weekly volatility.

As expected, the Federal Reserve left benchmark interest rates on hold following the latest FOMC meeting and also stated that rates will stay low for an extended period. The statement was slightly more optimistic over economic trends with comments that policy actions should contribute to a gradual recovery while inventories were more in line with production. The Fed also removed the previous warning that inflation could be undesirably low. The amount of bond buying was left unchanged.

The Euro-zone PMI manufacturing indices were firmer with the flash index rising to 42.4 from 40.7 the previous month. The services sector index edged slightly lower for the month, contrary to expectations of a measured increase, which will be a cause for some concern with fears that improvements are being driven by inventory adjustment.

The German IFO index rose to 85.9 for June from 84.2 the previous month, maintaining the improvement seen over the past few months. Companies were, however, still pessimistic over current conditions and IFO officials did not describe the improvement as defining a turning point for the economy.

The comments from ECB officials were generally supportive of the Euro with council member Weber stating that the bank had used up the space to cut interest rates. Weber did, however, also stated that it was essential to avoid premature tightening. The OECD also stated that there was scope for ECB to cut interest rates further.

The Euro secured a generally firmer tone on the main crosses during the week, but still found it difficult to make strong headway given lingering unease over the fundamental outlook. The Euro did find support near 1.38 and re-challenged the 1.41 level on Friday.

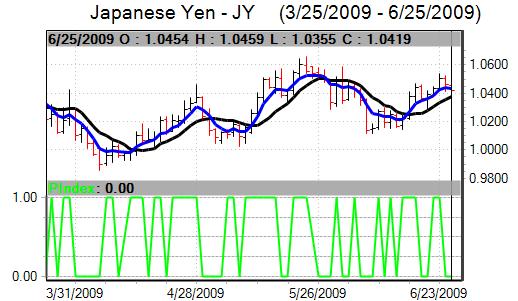

The dollar found solid support below 95 against the Japanese yen, although gains were very limited. The Japanese currency had a slightly weaker tone on the crosses with moves still generally measured.

Japan’s core consumer prices fell 1.1% in the year to May while there was a decline of 1.3% for Tokyo prices in the year to June which maintained underlying deflation fears within the economy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The latest capital account data was again important with net outflows from Japan of US$3.5bn in the latest reporting week as domestic investors looked to increase their exposure to higher-yield assets. It was the seventh successive week of outflows which undermined yen sentiment with further investment fund launches.

UK mortgage lending was still extremely subdued with the total declining to an 8-year low for May. The headline BBA mortgage approvals data was firmer than expected at a 13-month high which offered some prospects of recovery.

Comments from Bank of England officials again had a significant market impact. Chief economist Dale was generally cautious over prospects which pushed Sterling lower. Dale commented that a weaker currency was a key channel to spurring economic growth while the quantitative easing programme could be extended.

Bank Governor King repeated comments that the recovery was liable to be protracted while there was a very high degree of uncertainty.

King again warned over the fiscal position and called for the government to tighten policy if there was any sign of economic recovery. The outlook, together with stresses between the bank and government, tended to undermine sentiment to some extent.

Sterling was generally trapped within familiar ranges against the dollar during the week. It proved unable to break above 2009 highs above 1.66, but near-term technical support levels also held firm. Sterling weakened from 2009 highs against the Euro.

The Swiss currency moves were dominated by National Bank policies during the week as the franc moved sharply. The dollar weakened to lows below 1.0650 against the Swiss franc before rallying strongly to near 1.10 on Wednesday. The franc also weakened sharply from highs near 1.50 against the Euro with lows beyond 1.5350.

There was strong evidence that the National Bank was intervening in the market through the BIS. As well as intervention on the Euro/Swiss cross, there was also evidence that the bank had intervened to buy the dollar directly. Following the intervention on Wednesday, there was further important franc selling by the National Bank during Thursday, but the dollar was still weaker.