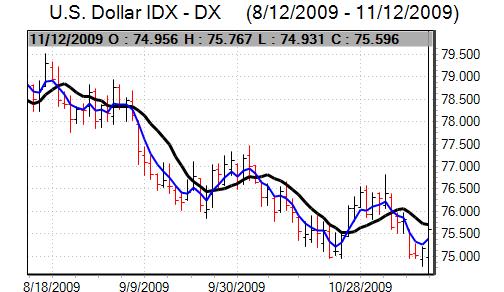

Global exchange rate policies had more of an influence during the week with a limited number of major data releases and no interest rate decisions. The dollar remained under pressure during the first half of the week and dipped to 2009 lows against core European currencies. The US currency then found some degree of support on technical grounds.

The US consumer confidence data was also weaker than expected with the IBD index declining to 47.9 for October from 50.3 the previous month. Although not a major survey, the data maintained the recent run of generally disappointing consumer confidence data and fears over weak spending trends.

The US jobless claims data was better than expected with a decline to 502,000 in the latest week from a revised 514,00 previously which sustained cautious optimism that there will be a very slow improvement in the labour market. The trade deficit rose significantly to US$36.5bn from US$30.8bn previously.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

There were several remarks from Fed officials during the week with all confirming a mixed picture for the economy. Governor Yellen stated that the Fed should monitor asset prices to assess the risk of any bubble developing and the general tone of the Fed comments suggested that there is increased unease over the threat of excessive asset-price rises on the back of very cheap financing.

Increased speculation surrounding renewed yuan appreciation against the dollar dampened expectations that there would be further European currency gains and this was a small negative Euro influence.

ECB President Trichet stated on Monday that currency levels had not been a subject for discussion at the BIS meetings, further dampening expectations of any official dollar support.

The Euro-zone data was stronger than expected with a further recovery in the Sentix business confidence index to -7 from -12.6 the previous month and this was the strongest figure since 2007. In addition, there was a further increase in German industrial production for September.

In contrast, the ZEW business survey weakened to 51.1 for November from 56.0 the previous month, maintaining a trend of slightly weaker confidence reports from Germany, although the indices are substantially above 2008 lows. There were also generally cautious comments from ZEW officials suggesting that the recovery had paused for now.

The German government announced that it would provide additional capital to WestLB which reminded markets of the underlying structural weaknesses and bad-debt problems surrounding the Euro-zone economy. ECB President Trichet stated that the extraordinary liquidity measures would be withdrawn in a timely manner which provided some currency support.

The yen was generally trapped within narrow ranges against the dollar during the week with neither currency able to sustain strong buying support. The dollar found support below the 89.50 level against the Japanese currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Increased speculation of a policy shift and a resumption of Chinese yuan appreciation provided some degree of background yen support on expectations of regional currency gains, although the immediate impact was limited.

Sterling continued to exhibit volatility during the week. There were sharp losses following the Bank of England inflation report, but it maintained a generally firm tone for the week as a whole with persistent Euro selling above the 0.90 level while Sterling was able to regain the 1.66 level against the dollar.

The latest RICS house-price and BRC retail sales data was stronger than expected, maintaining the recent trend of generally favourable data. Sterling was, however, undermined on Tuesday by a warning from Ratings agency Fitch that Sterling was vulnerable to a credit-rating downgrade.

In its quarterly inflation report, the Bank of England forecast that inflation would rise significantly over the next few months, but would decline to be slightly below the 2.0% target on a two-year view if interest rates were at expected market levels.

Bank Governor King was again generally downbeat on the economic prospects warning that would need to be a prolonged period of balance-sheet adjustment. King also suggested that the bank was open to all possibilities on quantitative easing, which increased speculation that there could be a further expansion while the Governor also repeated recent comments that Sterling’s decline was helpful.