Volatility tended to increase during the week as international risk appetite returned to a central role. The dollar was subjected to heavy selling pressure in the middle of the week and dipped to lows near 1.5150 against the Euro, the lowest level since July 2008.

The US currency was undermined from comments by regional Fed Governor Bullard. He stated that the Fed’s bond-buying programme should be extended beyond the current period to give greater policy flexibility for 2010. The comments reinforced expectations that the Fed would maintain a policy of very low interest rates. The dollar was also undermined by comments from the Russian central bank that it was set to diversify into the Canadian dollar as part of its reserve management operations.

The US data was mixed overall, but with a slightly firmer bias. There was a decline in jobless claims to 466,000 in the latest week from a revised 501,000 the previous week and the four-week moving average was at the lowest level for over 12 months which will maintain optimism over a gradual improvement in the labour market.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Durable goods orders fell 0.6% decline for October following a revised 2.0% increase for the previous month. There will be some unease over a sharp 2.9% decline in non-defence capital goods orders which suggests investment spending will be fragile.

The US housing data was again firmer than expected with new home sales rising to an annual rate of 0.43mn from a revised 0.405mn the previous month. The US housing data was stronger than expected with existing home sales rising to an annual rate of 6.10mn from 5.54mn the previous month, supported in part by the end of tax breaks. Inventories edged lower while prices also declined.

The estimate of US third-quarter growth was revised down to 2.8% from a provisional 3.5%, primarily due to the impact of higher imports and was in line with market expectations. Consumer confidence rose slightly to 49.5 for November from an upwardly-revised 48.7 the previous month as the future expectations index improved, although confidence in the labour market remained very weak.

Confidence in the US financial sector remained generally fragile with the FDIC reporting that the number of banks in difficulties had increased to over 550, the highest level since 1993. The FDIC also reported that the insurance fund had a negative balance which may force it to access a US$500bn Treasury credit line.

The FOMC minutes stated that Fed officials were more optimistic over a durable economic recovery and they were also uneasy over the potential risks of unwanted speculative activity if interest rates were left at low levels for an extended period. There was also some concerns over the potential inflation impact of dollar weakness.

The German IFO index was stronger than expected with a rise to 93.9, the highest level since August 2008. Provisionally, German consumer prices fell by 0.2% for November, although the annual inflation rate rose to 0.3% from unchanged the previous month due to the sharp decline in prices last year.

The latest Euro-zone money supply data recorded aslowdown in annual growth to 0.3% from 1.8% the previous month while private-sector loans fell by 0.8% over the year. The consistent slowdown in lending over the past few months will maintain fears over deteriorating credit conditions within the Euro-zone.

ECB President Trichet stated that the central bank would gradually phase out the extraordinary liquidity measures. The comments were in line with recent official comments and reinforced market expectations that the ECB move earlier than the Federal Reserve to tighten policy. There were no major protests over the Euro’s level.

The news that Dubai World, the government investment company, was looking to reschedule debt payments had a significant negative impact on risk appetite and also provided some significant dollar protection as Chinese equity markets dipped sharply. As risk appetite fell sharply, the dollar regained ground and moved back towards 1.48.

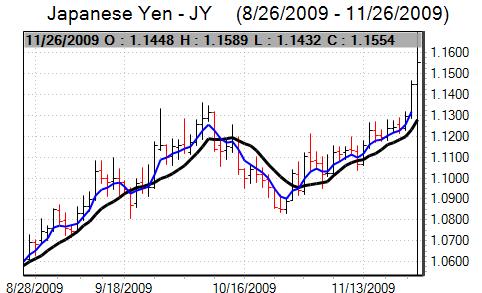

The dollar was subjected to sustained selling pressure, briefly weakening to a 14-year low below 85. Finance Minister Fujii warned that the Ministry was watching currency moves very closely and would be prepared to act against abnormal currency moves. Deputy Finance Minister Noda, however, stated that there were no plans to intervene. Markets remained sceptical that there would be any action to weaken the currency.

There are still important stresses in the Japanese economy with the latest Bank of Japan minutes stating that the special lending facility could be re-introduced next year and this will maintain pressure for yen gained to be capped.There were also calls for action from the business organisations. There has also been further friction between the government and Bank of Japan over the appropriate response to deflation fears with some criticism of the bank’s policies.

The yen was supported by comments from former very influential government official Sakakibara who stated that the dollar could weaken to the 80 level against the yen.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The dollar weakened sharply to lows near 0.99 against the franc before rallying back above the parity level later in the week. The Swiss currency gained ground against the Euro with a high near 1.50. There were rumours of National Bank intervention which helped trigger the dollar rebound in choppy trading.

Bank of England Governor King who again implicitly welcomed a weaker currency in testimony on the inflation report. King also stated that the economy faced profound challenges while the news that additional support had been provided to the banking sector during 2008 also undermined confidence

Bank officials were slightly more optimistic over near-term growth prospects and also stated that it was coming to the end of major quantitative easing measures. MPC member Sentance stated that it was too early to talk of monetary tightening.

There were fears that difficulties within Dubai could result in a withdrawal of investment funds from major markets such as the UK and this had a negative impact on Sterling with a wider increase in risk aversion also hurting the UK currency. Sterling dipped to lows below 1.63 against the dollar before finding support and also found support beyond 0.91 against the Euro.