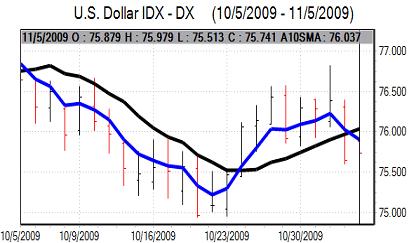

The US economy was a major focus during the week. The dollar was unable to extend or sustain the correction seen the previous week and dipped lower to test support levels beyond 1.49 against the Euro as risk appetite improved.

The US ISM index for the manufacturing sector was stronger than expected with an increase to 55.7 for October from 52.6 the previous month and this was the strongest figure since 2006. The pending home sales data was also robust with a further 6.1% increase for September after a 6.4% increase the previous month.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The services-sector index edged lower to 50.6 from 50.9 the previous month compared with expectations of a small increase. The data will reinforce fears over underlying vulnerability in the economy, especially as services are much larger that the manufacturing sector.

The ADP report recorded a private-sector employment decline of 203,000 for October which was slightly worse than expected, although it was an improvement from the previous month. The US economic data was slightly stronger than expected with jobless claims falling to 512,000 in the latest week from a revised 532,000 previously. There was a further strong gain in productivity for the third quarter and a sharp drop in unit labour costs as companies cut employment aggressively.

The monthly employment data was weaker than expected with a 203,000 decline in non-farm payrolls while unemployment rose to a 26-year high of 10.2%.

As expected, the Federal Reserve left the Fed funds rate on hold in the 0.0 – 0.5% range following the latest FOMC meeting. The Fed maintained that the economy was improving while the declines in employment and business investment had slowed.

There were still important areas of vulnerability and, critically, the Fed maintained the commitment to maintain interest rates at exceptionally low levels for an extended period. There was some reduction in agency debt purchases, primarily due to a lack of securities, with the Fed moving very slowly towards lessening the degree of stimulus.

There were increased fears over the European banking sector which undermined confidence and also reminded investors of the underlying Euro-zone structural vulnerabilities. Fitch also downgraded its credit rating for Ireland.

The Euro-zone retail sales data was weaker than expected with a further 0.7% decline for September to give a 3.6% annual decline, maintaining fears over the outlook for consumer spending.

There were no policy surprises from the ECB with interest rates left on hold at 1.00% following the latest council meeting. Bank President Trichet maintained a tone of cautious optimism over the economy, repeating his expectations for a very slow recovery while he drew attention to falling money supply and private loans. Trichet suggested that extreme liquidity measures would be gradually withdrawn during 2010. There were no substantive comments on the Euro from the bank head.

The Euro failed to hold its best levels following the US payroll data.

The dollar was unable to break above 91.50 against the Japanese yen and dipped to re-test support levels below 90. There was very choppy yen trading on the European crosses with net yen gains later in the week following the US data.

Bank of Japan Governor Shirakawa stated in comments on Wednesday that downward pressure on prices would continue, maintaining pressure for the central bank to maintain a very loose monetary policy. The Finance Ministry has also pledged additional policy measures next fiscal year to curb the budget deficit.

The UK PMI index for the manufacturing sector was significantly stronger than expected at a two-year high of 53.7 from a revised 49.9 figure the previous month. The services-sector index was also stronger than expected with a rise to a 56.9 from 55.3 and this was the highest figure since September 2007. The construction PMI index weakened to 46.2 for October from 46.7, maintaining unease over the sector.

The government announced a further support package for the UK banks as part of a wider restructuring scheme and the additional support could be close to GBP40bn.

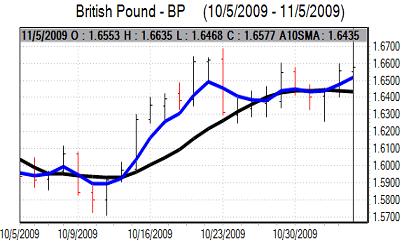

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

At the Bank of England MPC meeting, interest rates were left on hold at 0.50% as expected. The MPC also announced a further GBP25bn increase in the quantitative easing target to GBP200bn.

The bank was slightly more confident of a recovery in the economy, but still very concerned that the economy is facing a shortage of credit as the banks work to repair their balance sheets. The bank recognised that this is a difficult balancing act and there were concerns over potential policy errors over the next few months.

The latest NIESR data recorded an estimated 0.4% GDP decline in the three months to October which was weaker than expected. The data maintained fears that the UK recovery will lag behind other major economies.

There will be increased fears over the government debt position, especially as confidence is already very fragile. There will also be unease over underlying financial-sector vulnerability which will tend to be a negative factor for the currency.

Sterling strengthened to above 1.66 against the dollar following the decision, supported in part by a fragile dollar, and was able to consolidate above 1.65 on Friday. Sterling also held stronger than 0.90 against the Euro.