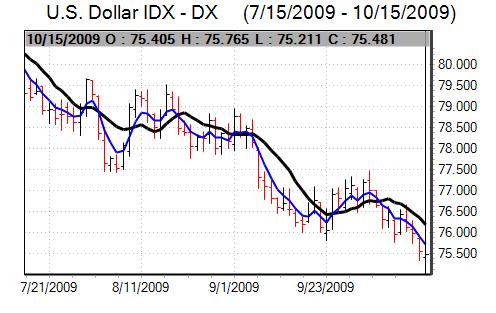

Dollar weakness remained a key market focus for the week as a whole as underlying confidence in the currency remained weak while positive risk appetite curbed defensive. The dollar dipped to 14-month lows on a trade-weighted basis and also weakened to near 1.50 against the Euro.

The headline US retail sales data was slightly stronger than expected with a 1.5% decline for September following a revised 2.2% increase the previous month. As expected, there was a sharp dip in auto sales and there was an underlying monthly increase of 0.5% following a 1.0% gain for the previous month.

The New York manufacturing PMI index was sharply stronger than expected with a reading of 34.6 for October from 18.9 the previous month. In contrast, the Philadelphia Fed index was slightly weaker at 11.5 from 14.1 the previous month. The industrial data as a whole will maintain optimism over near-term trends even with longer-term uncertainties still a feature.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Initial jobless claims also declined to 514,000 for the latest week from a revised 524,000 previously and this was the lowest reading since early January which will maintain optimism over a slow improvement in the labour market. Without tougher rhetoric from the Federal Reserve, the dollar is finding it difficult to gain support from firm data, especially with firm global risk appetite lessening defensive demand.

Consumer prices rose 0.2% for September which was in line with market expectations while there was also a 0.2% increase in core prices. There was a 1.3% annual decline in prices as food prices fell over the year for the first time in over 40 years, but underlying inflation was at 1.5% which does not suggest a serious deflation threat.

The FOMC minutes from September’s policy meeting revealed important differences over the economy’s direction and appropriate policy responses. There was no support for higher interest rates at the meeting despite evidence of improving economic conditions with fears that pre-emptive action would damage any recovery. Some members wanted the quantitative easing policies to be ended early while others were looking for an extension of mortgage-security buying.

The latest German ZEW survey dipped to 56.0 for October from 57.7 the previous month which was below market expectations and maintained expectations that the Euro-zone economic recovery is liable to stall relatively quickly.

ECB President Trichet remained cautiously optimistic over the Euro-zone economic outlook, although markets mainly concentrated on his remarks surrounding currencies. Trichet stated that excessive currency movements were an enemy which suggested that the tone of rhetoric has become slightly stronger.

The dollar dipped to lows beyond 1.4950 against the Euro and the trade-weighted index dipped to a 14-month trough. Commodity currencies continued to advance strongly with the Australian dollar peaking above 0.9250 against the US dollar while the Canadian dollar strengthened to near 1.02 before correcting weaker.

After a generally firm tone over the first half of the week, the yen weakened significantly over the second half with notable weakness against Sterling. In comments on Wednesday, a Finance Ministry official stated that intervention was undesirable and that the yen moves were primarily a function of dollar weakness.

Finance Minister Fujii stated that countries should avoid competitive devaluations and there was further pressure for the authorities to block yen gains. After initially edging firmer on Thursday, the dollar pushed to highs around 91.20 with the yen generally weaker on the crosses as risk appetite remained stronger.

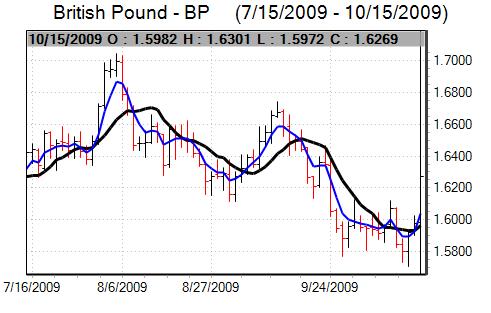

Sterling remained under pressure in the first half of the week and dipped to 7-month lows against the Euro near the 0.94 level. The CEBR institute stated that interest rates were likely to stay at very low levels for at least three years with borrowing costs not likely to move above 2% until 2014.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The latest RICS housing survey recorded an increase in prices for September with the index at a 28-month high while the retail sales data was also stronger than expected. The currency was still trapped near 1.58 against the dollar in Asia.

The headline consumer inflation rate was weaker than expected with a decline to 1.1% for September from 1.6% previously which was the lowest annual rate for five years. The other inflation data was slightly stronger, but the net impression was that there will be greater scope for the Bank of England to keep interest rates very low.

The latest labour-market data was better than expected with the claimant count rising 20,800 in the latest month compared with expectations of a 25,000 increase while the unemployment rate held at 7.9%. The claimant count increase was the slowest since May 2008 which provided some degree of Sterling relief, although the overall unemployment rate was at a 14-year high.

There were also comments from Bank of England officials which suggested that there would be less scope for further quantitative easing with the bank potentially suspending the programme in November, although uncertainty was a key feature.

There was an aggressive bout of short covering later in the week which helped trigger a sharp recovery with a move to above 1.6350 against the dollar and 0.9150 against the Euro.