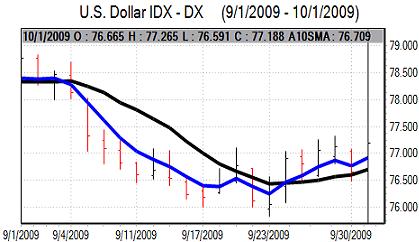

There was a slightly more cautious attitude towards risk as equity markets came under selling pressure and some expectations that G7 would move to underpin the dollar which curbed selling pressure. ECB President Trichet stated that it was extremely important to have a strong dollar which reinforced speculation that the global authorities are looking to stabilise the US currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The dollar secured a slightly firmer tone with an advance to a peak just beyond 1.45 against the Euro after the payroll data, but was unable to make strong headway.

The Chicago PMI index was significantly weaker than expected with a decline to 46.1 from 50.0 the previous month, contrary to expectations of a further modest advance. Although the Chicago data is erratic on a monthly view and is influenced by the auto sector, there were some concerns over the economic situation.

The ISM index for manufacturing was also weaker than expected with a small decline to 52.6 for September from 52.9 and compared with expectations of an increase to 54.0. The PMI data had a greater market impact with a retreat for commodity prices.

The US housing data was firmer than expected with the Case-Shiller index recording a third successive monthly increase which cut the annual decline to 13.3%. US pending home sales data was stronger than expected with a further 6.4% increase for August which was the sixth successive monthly increase.

In contrast, consumer confidence was weaker than expected with a fall to 53.1 in September from 54.5. The deterioration is particularly surprising given that the University of Michigan confidence index had registered a significant advance.

The ADP employment report was weaker than expected with recorded net job losses of 254,000 for September following a revised 277,000 decline the previous month. The monthly employment report was also weaker than expected with an employment decline of 263,000 for September after a revised 201,000 drop previously.

Regional Fed President Fisher gave generally downbeat comments on the housing sector. However, he also stated that a policy reversal by the Federal Reserve could be equal in speed to the policy easing seen in 2007/08. These comments follow hawkish comments from Governor Warsh and maintained speculation over a more aggressive Fed policy even though Fisher is not an FOMC voting member this year. Kohn stated that it was not possible to predict how rapidly interest rates would be increased.

The CDU victory in Germany’s Federal election provided an initial Euro boost, but the Euro was unable to sustain momentum during the week as a whole.

The Euro-zone data recorded a better than expected figure for German unemployment with a 12,000 seasonally-adjusted decline for August. There was a poor German retail sales report with a reported monthly decline of 1.5% which put some initial downward pressure on the Euro.

The inflation data was slightly weaker than expected with a flash consumer inflation reading of -0.3% for September compared with expectations of -0.2%.

EU’s Almunia stated that the Euro’s level would be discussed at the weekend G7 meeting. The comments reinforced market speculation that officials were looking to take a more determined tone in curbing Euro gains.

In testimony to the European parliament, ECB president Trichet stated that there was a gradual economic recovery, but that it was not yet time for an exit from the highly-accommodative monetary policies.

After a spike stronger, to highs near 88.20, the yen had a slightly weaker tone against the dollar, but remained generally resilient. Finance Minister Fujii stated that he would not rule intervention and the comments suggest that rapid yen gains have unsettled the government.

The headline Tankan business confidence index improved to -33 for the current quarter from -48 previously which was close to market expectations while there was a further downgrading of capital spending intentions to a 10-year low.

There was a significantly stronger than expected UK CBI retail survey for September with the headline reading rising to +3 from -16.

There were reported Bank of England comments that it would not consider a cut in deposit rates in the short term while there were suggestions that the bank was unhappy with the market reaction to King’s earlier comments on Sterling. These remarks suggested that there is unease over the risk of a sharp downward Sterling move with the bank looking to curb market expectations of a sharp decline.

The PMI index for manufacturing was weaker than expected with a dip to 49.5 for September from 49.7 previously. The data has been in contrast to gains in European PMI indices which maintained a generally cautious market tone towards Sterling.

Sterling fell sharply early in the week with multi-month lows beyond 0.92 against the Euro and a dip to below 1.58 against the dollar. The UK currency secured some corrective recovery with rallies still attracting selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

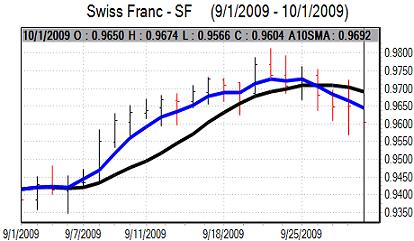

The Swiss franc generally proved resilient during the week before being jolted weaker with rumours that the National Bank had intervened. The franc recovered from initial losses and consolidated near 1.04 against the dollar. From lows below 1.51, the Euro rallied strongly to test the 1.52 region before consolidating around 1.5165. As usual, the central bank declined to comment on the intervention rumours.