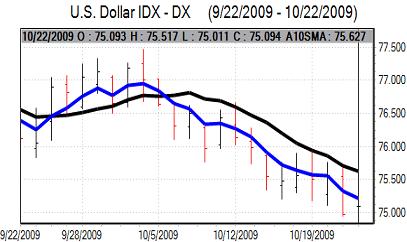

Markets continued to focus on dollar weakness for much of the week. The US currency remained under pressure on further expectations of a medium-term diversification into alternative currencies. Despite intermittent rallies, the dollar tested 14-month lows against core European currencies with a low around 1.5060 against the Euro. The trade-weighted index also dipped to 2009 lows.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The US housing data was slightly weaker than expected with starts broadly unchanged in the latest month at an annual rate of 0.59mn while permits declined to slightly to 0.57mn. Following the NAHB data on Monday, there were some fears that the housing recovery will stall over the next few months.

The US employment data was weaker than expected with an increase in initial jobless claims to 531,000 from a revised 520,000 the previous week, but markets will look to assess several weeks of data before concluding that the recent labour-market improvement may have reversed.

Elsewhere, leading indicators rose by a further 1.0% for the month while there was a 0.3% decline in house prices according to the latest monthly survey. Headline producer prices fell 0.6% for the month with a 0.1% core decline for the month which will help ease immediate fears over any inflationary impact of a weak dollar.

The Fed Beige Book reported that the economy was making modest gains led by manufacturing over the past few weeks with little or no price pressures. Labour markets were described as weak or mixed while credit standards continued to tighten. There was also a reported deterioration in commercial real-estate across all districts which maintained fears over renewed stresses within the banking sector. In this environment, there were doubts whether risk appetite could maintain strength.

The Brazilian decision effectively to introduce capital controls will have some impact in curbing aggressive capital inflows into emerging markets and this also curbed dollar selling to some extent.

Markets continued to market comments from European officials closely to assess the potential for more aggressive policy action above the 1.50 region. Euro-group head Juncker stated on Monday that EU countries are concerned with currency rates.

The Euro was unsettled briefly by the announcement of a Fitch credit-rating downgrade for Greece. The Euro PMI indices continued to move higher for October while the German IFO index rose to 91.9 from 91.3 which was marginally below expectations.

Although the tight yen relationship with risk appetite has faded to some extent during October, there was still some selling as global confidence increased and the dollar was able to find support close to 90 against the yen with a move towards 91.70. In contrast, the dollar dipped to lows near parity against the Swiss franc.

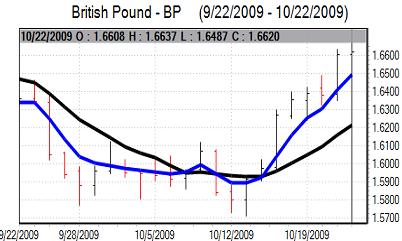

According to the latest Bank of England MPC minutes, there was a 9-0 vote to keep interest rates on hold at 0.50% and to maintain the quantitative easing programme at the current GBP175bn level. The unanimous vote will provide some underlying Sterling support as expectations over an expansion of the bond-buying programme in November are likely to be scaled back.

It is particularly important that Bank Governor King appears to be taking a more slightly more confident stance over the economy as he had been an important proponent of quantitative expansion during the Summer.

Deputy Governor Tucker stated that the quantitative easing programme could be extended if conditions warrant action and these comments also had a negative currency impact. Nevertheless, the majority view was moving towards policy being left on hold in November which curbed Sterling selling pressure.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The latest government borrowing requirement was GBP14.8bn for September which was slightly better than expected, although the deficit for the first six months of the fiscal year was at a record GBP77.3bn.

The UK monthly retail sales data was weaker than expected with sales unchanged for September for the second consecutive month compared with expectations of a 0.5% increase. The GDP data was also weaker than expected with a third-quarter contraction of 0.4% compared with expectations of a small increase.

Sterling secured a significant advance against the dollar over the week as the theme of short covering continued with a peak near 1.67 before selling pressure returned. The Euro found support close to 0.90 against the UK currency. As the economy remained in recession, Sterling moved sharply weaker.