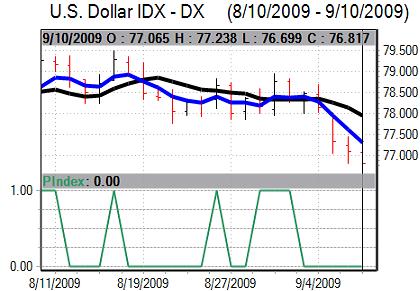

Market activity was stifled early in the week by the US Labor-day holiday, but the general theme was a trend towards US dollar weakness. The US currency dipped to 12-month lows against the Euro as there was evidence of general selling with the trade-weighted index also at 2009 lows.

There was further speculation over medium-term reserve diversification away from the US currency. There were also greater expectations that the dollar would be used as a global funding currency as short-term interest rates declined to record lows with Libor rates dipping to below Japanese rates.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The US trade deficit rose sharply to US$32.0bn for July from a revised US$27.5bn the previous month and this was the biggest percentage monthly increase for 10 years. There was a sharp increase in exports and imports over the month which maintained optimism over an improvement in conditions and a recovery in trade volumes.

Elsewhere, initial jobless claims fell to 550,000 in the latest week from a revised 576,000 previously while continuing claims fell. The data maintained expectations that the labour market is gradually improving, but remains very weak in historic terms and did not signal a peak in unemployment.

In the Federal Reserve’s Beige Book report, most districts noted a gradual improvement in conditions while manufacturing was expanding. Housing and commercial property demand was still very weak while credit standards were tight and inflation pressures were weak while the labour market was also still very fragile.

The report overall created some degree of caution over the economy and stemmed any further strong improvement in risk appetite. Fed officials reinforced their medium-term determination to curb inflation pressures, but suggested that policy stimulus would not be withdrawn at this stage.

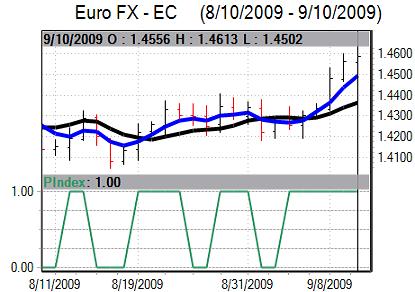

The Euro-zone Sentix business confidence index improved for September. There was also a larger than expected 3.5% increase in German factory orders for August, although the annual decline was still close to 20.0%. The Euro also gained some initial backing from the latest German trade data with a 2.3% monthly increase in exports.

There was a surprise 0.9% decline in German industrial production for July after a revised 0.8% increase the previous month, but the negative Euro impact was short lived with investors more confident over the near-term outlook.

ECB council member Weber repeated recent ECB comments that it was too early for the bank to make an exit from the extraordinary policy measures, although monetary developments did need to be watched very closely.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are nearly 80% accurate*. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Euro maintained a generally firm tone over the week with an advance against the dollar to highs above 1.46 a main focus while the currency struggled to secure strong gains on the crosses.

The Japanese currency probed 7-month highs against the dollar over the week and was generally resilient on the crosses, although it was unable to make significant headway. The dollar dipped to lows near 91 against the yen on Friday. The dollar also dipped to test 2009 lows near 1.0350 against the Swiss franc during the week .

UK industrial production rose 0.5% in July after a revised 0.6% gain the previous month which will helped underpin sentiment towards the manufacturing sector and also push Sterling stronger.

The NIESR institute also reported GDP growth of 0.2% in the three months to July which reinforced speculation that the recession has ended, although there was also major caution over the outlook with a warning of stagnation.

The visible trade deficit was unchanged at GBP6.5bn for July. There was a tentative increase in import and export volumes which could offer some degree of support, but the data did not have a major impact on the currency.

The Bank of England left interest rates on hold following the latest MPC monetary policy meeting and the amount of quantitative easing was also left unchanged at GBP175bn. The bank is expecting the current bond buying programme to be completed within the next two months.

There had been some speculation that the bank would expand its quantitative easing and the decision to maintain a steady policy provided some relief with speculation that the bank was now slightly more optimistic which boosted Sterling confidence.

Sterling was able to resist further selling pressure during the week and eventually pushed towards 1-month highs above 1.67 against the dollar. There was also buying support weaker than 0.88 against the Euro.