The US data releases had a mixed impact over the week while risk appetite was relatively steady and attention switch more towards the Euro-zone over the week as policy uncertainties increased.

ECB council member Weber made potentially significant remarks. He stated that inflationary pressures were continuing to ease which suggested the scope for lower interest rates. Very importantly, Weber also suggested that non-standard policy measures would probably be introduced at the May council meeting.

Given that Weber is traditionally a hawk on monetary policy measures, the remarks were significant, although there is still the risk of divisions within the council.

President Trichet also stated that a strong dollar was in its interest while the Euro could not be described as weak and this renewed speculation that the bank would resist any significant Euro gains to help preserve competitiveness.

The US consumer spending data was weaker than expected with a headline 1.1% decline in retail sales for March while there was a core 0.9% fall, although there was an upward revision to the February data which offset the impact.

Industrial production was weaker than expected with a further 1.5% decline for March to give the worst quarterly decline for 60 years. In contrast, the more forward-looking New York manufacturing index was stronger than expected with a recovery to -14.7 in April from a record low of -38.2 the previous month. The Philadelphia Fed index also improved to -24.4 in April from -35.0 with a very weak employment component.

The housing sector data remained very fragile with starts falling to an annual rate of 0.51mn for March from 0.57mn the previous month. This was the second lowest reading on record while permits also declined to 0.51mn for the month.

Initial jobless claims fell to 610,000 in the latest week from 663,000 previously which suggests that the rate of layoffs may be slowing slightly, but continuing claims were again above expectations at a record level above 6.0mn. The steep rise in continuing claims will continue to act as a drag on the economy and restrain confidence.

Headline consumer prices fell 0.1% for March which gave a year-on-year decline of 0.4% and this was the first annual decline since 1955. Core prices rose 0.2% for the month, however, and there was a 1.8% annual increase which illustrated that there is only a limited risk of deflationary pressure at this time.

The Fed’s Beige book reported that the rate of economic contraction declined in five of the 12 Fed districts while there was some evidence of very weak stabilisation in the housing sector. The employment situation remained very weak across all regions.

Fed Chairman Bernanke stated cautious optimism that the rate of decline in the economy was starting to slow and that this was a pre-requisite for a recovery. Markets continued to watch the corporate earnings data very closely with better than expected earnings from the banking sector curbing defensive dollar demand.

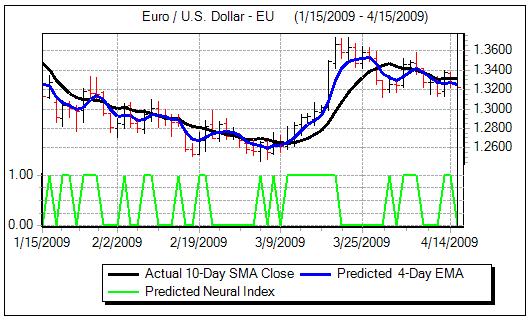

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The dollar weakened sharply on Monday, reversing gains seen at the end of the previous week with lows close to 1.34 as liquidity was limited. Over the remainder of the week, the dollar edged firmer and pushed to 1.3050 after breaking important Euro support levels near 1.31.

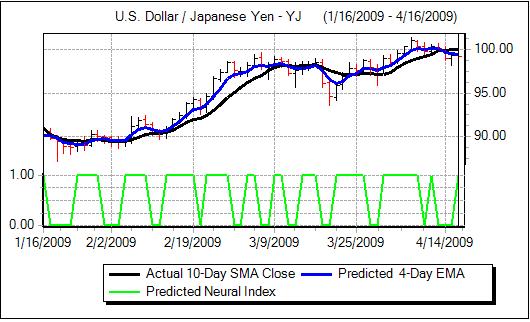

The yen was trapped in narrower ranges over the week with the dollar consolidating around the 99.50 level. The markets looked to challenge technical levels, but moves quickly reversed as there was little confidence in underlying trends.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Japanese monthly Tankan index edged higher to -76 in April from -78 previously which will maintain hopes that there will be some stabilisation in the domestic and regional economy which will also lessen the negative impact of very weak data. The consumer confidence data also strengthened to a six-month high.

The latest UK RICS data was also stronger than expected for March with increased buyer interest for the fifth consecutive survey although 73% of surveyors still reported that house prices declined in the latest month.

The UK fiscal conditions were watched closely ahead of next week’s annual budget and fears over the debt outlook tended to restrain Sterling. The budget deficit is expected to be over 10% of GDP for the current fiscal year which will certainly limit the scope for any further fiscal measures to support the economy.

Sterling pushed to highs just above 1.5050 against the dollar, the highest level since the beginning of January, but failed to sustain the gains and dipped to lows below 1.4800 on Friday. Sterling also retreated from highs near 0.88 against the Euro.

The dollar found good support close to the 1.13 level against the Swiss franc and strengthened to highs near 1.1680 on Friday. The franc initially proved resilient against the Euro and strengthened to test levels below 1.51 before weakening back to near 1.52. National Bank Chairman Roth stated that intervention would continue as long as needed.