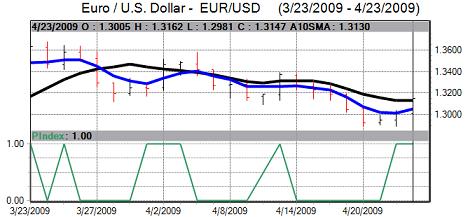

There was a slight shift in sentiment towards the US and Euro-zone economies over the week and this made it more difficult for the US currency to make ground.

The dollar pushed stronger over the first half of the week, but it struggled to make decisive gains and then weakened against most major currencies. Markets were still split over economic direction, although they were still trying to take a relatively optimistic stance over the outlook. There some Chinese comments warning over potential reserve diversification and this was an important factor in restraining dollar demand late in the week.

The banking-sector results were mixed over the week. Headline results from the Bank of America, for example, were better than expected which offered brief reassurance, but there was unease over the further rise in troubled loans with particular fears over the credit-card sector.

There was caution ahead of the Friday announcement on bank stresses tests with the Treasury due to provide full methodology and this guidance will give a good idea as to the outcome of the tests. There were rumours that several banks would effectively be declared insolvent which undermined confidence in the economy and also curbed risk appetite which provided some degree of initial dollar support.

As far as the US economic data is concerned, initial jobless claims increased to 640,000 in the latest week from a revised 613,000 previously, dampening hopes of a labour-market improvement, while continuing claims also rose sharply again to a record 6.137mn which also indicated that new jobs were still very hard to find.

Existing home sales slowed to an annual rate of 4.57mn in March from 4.71mn the previous month. Prices were generally firmer for the month, while there was still a sharp decline over the year.

The German ZEW business confidence index rose to 13.0 for April from -3.5 previously which was the first positive reading for two years and the sixth consecutive gain. The IFO index also rose by more than expected for April.

The other Euro-zone data was also generally better than expected with the PMI index for manufacturing rising to a six-month high of 36.7 from 33.9 the previous month while the services-sector index strengthened to 43.1.

ECB President Trichet tried to play down the possibility of splits within the central bank council in comments during the week. He also stated that interest rates could be cut by a further 0.25% to 1.00%, but not by more. The comments had only a limited impact on sentiment towards the currency with markets still speculating over significant policy divisions ahead of the May council meeting.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

As fears over the economy eased very slightly, the Euro gained significant ground late in the week with a move to above 1.32 against the dollar.

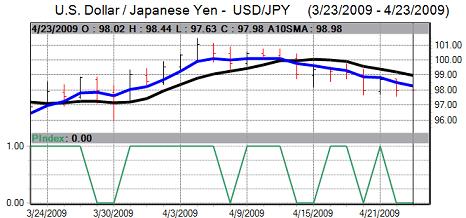

The Japanese currency was trapped within relatively narrow ranges for much of the week overall even though there were periods of choppy trading. There were gains to a four-week high near 96.80 against the dollar on Friday while the yen regained some ground against the Australian dollar.

The headline Japanese trade account was slightly stronger than expected with a small surplus for March. There was still a severe annual downturn in exports, but there was a small monthly increase in shipments for the first time in for 10 months which triggered some hopes that the industrial downturn was at least easing.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

UK GDP fell by a sharper than expected 1.9% for the first quarter of 2009, the weakest performance since 1979 while retail sales edged higher for April. The headline UK unemployment claimant count increase was lower than expected at 73,600 for March which provided some slight relief given expectations that unemployment would increase by more than 100,000.

The headline consumer inflation rate fell to 2.9% in March from 3.2% the previous month while the RPI rate was -0.4%, the first negative reading since 1960. The impact was limited as all figures were close to market expectations.

The government announced an expected budget deficit of GBP175bn for the fiscal year starting in April with only a marginal decline the following year and gilt issuance of GBP220bn. Borrowing at this level would represent 12% of GDP and this assumes that the economy stabilises before the end of 2009. Tax increases were also announced for the following year to help trim the deficit.

Sterling dipped sharply in the middle of the week following the UK budget release and debt forecasts, but it still proved generally resilient against the dollar. Sterling did weaken significantly against the Euro with lows beyond 0.90.

In an unexpected move, the Bank of Canada cut interest rates by a further 0.25% to 0.25%. The bank downgraded its economic forecasts and also stated that interest rates could he held at the 0.25% level for at least 12 months. The bank also outlined quantitative easing measures.

In the subsequent monetary report, the bank suggested that it would not implement quantitative easing at this time and this provided Canadian dollar support despite a forecast that first-quarter annualised GDP could contract by at least 7.0%. From lows around 1.25, the Canadian dollar recovered to 1.2150 against the US dollar.