Degrees of risk appetite remained very important for market direction over the week. The US currency gained initial support on defensive grounds as there was increased speculation that the Administration would force General Motors into bankruptcy rather than provide additional funding.

Following the G20 meeting, there was an announcement of a US$1trn support package through additional funds for the IMF and resources to finance global trade. There were doubts over the plans, but it was sufficient to underpin risk appetite while Wall Street was robust.

The US labour-market data remained extremely weak with ADP reporting a record 742,000 employment decline for March after a revised 706,000 drop previously. Initial jobless claims rose to a fresh 26-year high of 669,000 week from a revised 657,000. Continuing claims also rose to a fresh record high of 5.73mn in the latest week. Non-farm payrolls declined by 663,000 in March while unemployment rose to 8.5% from 8.1% and weekly hours declined.

The headline manufacturing PMI index edged slightly higher to 36.3 for March from 35.8 previously and the orders component rose to the highest levels since October which suggested that the aggressive period of inventory adjustment may be easing. In this environment, risk appetite improved slightly and defensive dollar demand eased, especially as Wall Street continued to post solid gains.

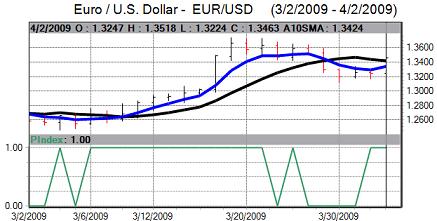

The Euro initially weakened as there were further credit-rating downgrades for European countries with Irish and Hungarian debt ratings both cut during the week. The Euro rallied firmly following the ECB policy meeting, notably against the yen.

The Euro-zone economic data remained generally weak with business confidence weakening to a fresh record low while Spanish inflation turned negative. The flash Euro-zone inflation rate fell sharply to 0.6% in March from 1.2% previously while unemployment continued to rise.

The ECB cut interest rates at the council meeting, but the decision was a surprise as the reduction was held to 0.25% to 1.25% compared with expectations of a 0.50% cut.

In the news conference, President Trichet stated that the inflation outlook was now more balanced. Comments over the economy were still very cautious, but he steered away from an overly-pessimistic stance. Trichet also pointedly stated that the ECB did not rule out further rate cuts.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

As far as quantitative easing is concerned, the Trichet stated that a decision on whether to decide on non-standard measures would be taken at next month’s meeting. The decision and policy stance provided near-term Euro support.

After strengthening to highs near 1.31 against the Euro, the dollar retreated to lows around 1.35 following the ECB decision.

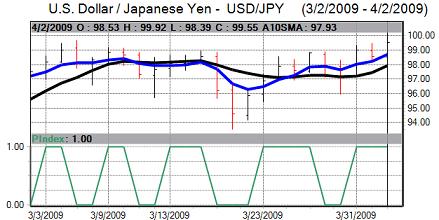

The Japanese yen rallied strongly at the beginning of the week with gains to beyond 96 against the dollar, but then weakened steadily. The dollar attacked 2009 highs just above the 100 level while the Euro re-challenged six-month highs against the yen. The Australian dollar strengthened sharply against the yen and also strengthen to 2009 highs against the US dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Capital repatriation flows eased as the new fiscal year started and this undermined the currency. Underlying yen sentiment also remained weak and there was also evidence of increased retail yen selling as global risk appetite improved.

The April Japanese Tankan business confidence survey was even worse than expected with a record decline to -58 from -24 the previous quarter while the index was also at an all-time low.

Sterling gained support from an improvement in global risk appetite and the benchmark FTSE index pushed above the 4000 level for the first time since February.

The PMI index for the manufacturing sector rose to 39.1 in March from 34.7 previously which was the highest level since October. This data was a positive influence as it suggested that there has been significant success in cutting inventories and the services PMI data was also stronger than expected. Mortgage approvals rose to the highest level since May 2008 with a monthly increase to 28,000.

The Nationwide reporting a surprise 0.9% monthly increase in house prices for March compared with expectations of a further decline, although the series is volatile and the Halifax recorded a 1.9% monthly decline in prices.

The latest Bank of England credit conditions survey reported that lenders expected slightly easier conditions during the second quarter which will also help improve confidence surrounding credit availability while consumer confidence improved.

Sterling found support close to 0.94 against the Euro with gains to beyond 0.91 and also bounced from support levels below 1.42 against the dollar. The UK currency rallied firmly to highs above 1.48 against the US dollar as domestic and international factors provided support.

National Bank member Hildebrand warned again over the currency. The comments from the central bank were unusually stark as he stated that it will use all measures available to prevent further gains for the Swiss currency and curb the deflation threat.

Following the aggressive central bank rhetoric, the franc weakened to lows around 1.5280 against the Euro and maintained a weaker tone on Friday.