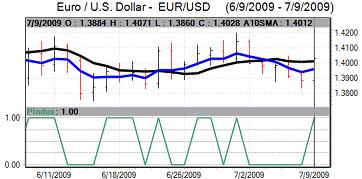

Trends in risk appetite continued to have a very strong market influence. The dollar strengthened sharply in the middle of the week, primarily due to a surge in risk aversion. The US currency still found it very difficult to sustain gains as underlying sentiment remained weak with underlying ranges relatively narrow.

The Chinese Foreign Ministry offering further reassurance on the dollar which helped underpin the currency. Comments from Russian and Indian officials were less supportive. The debate remain a very important underlying issue with more equivocal comments from Chinese officials later in the week increasing speculation over policy divisions. There were no strong references to currencies at the G8 meetings during the week with members generally cautious over recovery prospects.

The US ISM index for the non-manufacturing index strengthened to 47.0 for June from 44.0 the previous month and this was above market expectations. Most components improved, although employment was still at a very low level.

US initial jobless claims fell to 565,000 in the latest week from a revised 617,000 the previous week and this was the first week below the 600,000 level sine January. The data will tend to revive hopes that the economy is stabilising, although there was still be a high degree of uncertainty given the seasonal considerations. The number of continuing claim also rose sharply which suggested that conditions are still very tough which limited positive sentiment towards the economy.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

The Euro-zone Sentix index was weaker than expected with a deterioration to -31.3 for June from -27.0 the previous month which reinforced fears that any improvement in the economy would stall quickly. In addition, there were renewed fears over the regional banking sector following larger than expected losses at the German IKB bank. Confidence in Eastern Europe also tended to deteriorate during the week.

In contrast, the German factory orders data was sharply stronger than expected with a 4.4% monthly increase in orders compared with expectations of a marginal increase. Industrial production also rose 3.7% for May following a revised 2.6% decline the previous month. The data increased hopes that the economy had hit a low point and alleviated underlying fears to some extent

The German trade surplus was slightly higher than expected at EUR10.3bn for May which provided some degree of relief over trends in exports with a marginal 0.3% increase in shipments for the month.

The Euro weakened sharply against the yen in mid week and also dipped to lows near 1.38 against the dollar. There was an interim recovery against the dollar before renewed selling on Friday with significant weakness on the crosses.

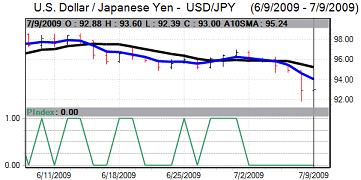

The dollar was unable to make any significant headway against the Japanese currency over the first half of the week and weakened to test important levels near the 94 level. Once support here was broken the Japanese yen strengthened sharply with dollar lows just below the 92 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

The yen was supported by a sudden deterioration in risk appetite as global growth fears increased and stock markets were subjected to sustained selling pressure.

The UK industrial data was significantly weaker than expected with a 0.6% decline in output for May following a revised 0.2% increase the previous month with manufacturing production also declining. The NIESR reported a 0.4% GDP decline in the three months to May following a revised 1.3% decline the previous month. The institute reversed its view that the economy had bottomed in April and stated that conditions were now broadly stagnant.

The Halifax house price index recorded a 0.5% decline in prices for June for a 15.0% annual decline which suggested that the underlying pressures have eased, at least on a short-term basis. The growth-related data overall tended to be a negative factor for Sterling as it raised further doubts over recovery prospects.

As expected, the Bank of England left interest rates on hold at 0.50% following the latest MPC policy meeting. The central bank also announced that the quantitative easing programme would be maintained at GBP125bn, contrary to some expectations of an increase and this provided an immediate boost to Sterling.

The bank announced that there would be a review at the August meeting when the latest inflation report will be available. There were still some expectations that the bank will increase the bond buying next month and this tended to curb any significant improvement in sentiment towards the currency.

Sterling weakened sharply in mid week as domestic doubts were compounded by a spike in risk aversion although the currency still proved broadly resilient. There was support near 1.60 against the dollar and beyond 0.8650 against the Euro.