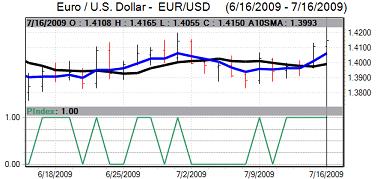

Global risk appetite continued to have an important impact on currency markets. The dollar posted gains early in the week, but was unable to break any important Euro support levels and was then on the defensive for much of the time. Risk appetite improved significantly which undermined demand for the dollar and the trade-weighted index dipped to a one-month low before a slight recovery.

The US retail sales data failed to have a substantial impact as it was close to expectations. Headline sales rose 0.6% in June after a 0.5% increase the previous month while there was a 0.3% underlying increase.

The other growth-orientated data was mixed, but offered some degree of support with the New York Empire manufacturing index strengthening to -0.6 in July from -9.4 the previous month which was the strongest reading sine October last year. The decline in industrial output also slowed to 0.4% in June from a revised 1.2% decline previously while there was a further small decline in capacity use to 68.0% from 68.2%.

Initial jobless claims fell again to 522,000 in the latest week from a revised 569,000 the previous week. There was again a high degree of distortion from the auto sector as seasonal layoffs were lower than usual due in part to the number of job cuts already announced.

The Philadelphia Fed manufacturing index weakened to -7.5 for July from -2.2 the previous month as optimism over future business conditions deteriorated, although the orders component was at a 10-month high. The data will spark some degree of unease over industrial trends later in 2009. The housing data was firmer than expected with starts rising to an annual rate of 0.58mn, the strongest figure since November.

US consumer prices rose 0.7% in June as gasoline prices rose sharply while there was a core increase in prices of 0.2% which was in line with expectations. Overall consumer prices still fell 1.4% over the year while there was a 1.7% underlying increase. The producer prices data was stronger than expected with a 1.8% monthly increase while core prices rose 0.5%

The latest capital account data recorded net long-term outflows for May of US$19.8bn compared with net inflows of US$11.5bn the previous month. Chinese Treasury holdings didincrease over the month, but the net outflows maintained underlying market fears over a medium-term move away from the US currency.

The Federal Reserve minutes from June reported mixed views with a majority still very concerned over the economy, although there were also some increase in medium-term inflation fears. The Fed raised its 2009 GDP forecasts slightly, although the unemployment forecasts were also increased.

There was a weaker than expected German business confidence survey with the ZEW index falling to 39.5 for July from 44.8 the previous month. This was the first monthly decline sine October and, although the data was still substantially higher than levels seen in late 2008.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

The Euro maintained a firm tone during the week, although it was still finding it difficult to make strong headway with resistance levels difficult to break down. Confidence was underpinned by an improvement in risk appetite and the Euro pushed to highs near 1.4150 against the dollar before a modest correction.

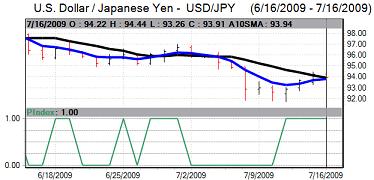

The Japanese currency was unable to strengthen through 92 against the dollar during the week and had a slightly weaker tone, although there was support beyond the 94.40 region with the Japanese currency broadly resilient.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Risk appetite was underpinned to some extent by stronger than expected Chinese GDP data with a 7.9% annual growth figure for the second quarter. There was, however, a credit rating downgrade of New Zealand’s debt which triggered some reassessment of the situation In overall terms, the yen was still able to resist heavy selling given the push higher in equity markets.

The headline UK unemployment claimant count increase was lower than expected at 23,800 compared with expectations of an increase of over 40,000 for the month which provided some degree of initial support for the UK currency.

The ILO unemployment rate, however, was significantly worse than expected with an increase to 7.6% from 7.2% the previous month and this represented the biggest quarterly increase in unemployment on record with the level rising to a 12-year high. There was some suspicions that the claimant count is being kept artificially low.

The headline UK consumer inflation rate fell to 1.8% in June from 2.2% previously which was in line with market expectations while the retail prices index fell 1.6% over the year. The decline to below the target level increased speculation that the Bank of England could move to expand the quantitative easing.

The IMF warned that the UK government may need to take more action to stabilise the financial sector which undermined confidence to some extent and the IMF also warned over the debt situation which tended to reinforce underlying market fears.

Sterling proved broadly resilient for much of the week and pushed to a two-week high towards the 1.65 level against the dollar while the UK currency was little changed against the Euro. Sterling then retreated significantly from its best levels late in the week as the debt fears increased.