The US economic conditions and medium-term reserves policies continued to have an important impact on the US currency. Currencies struggled to break out from recent ranges as moves quickly stalled. Risk appetite was generally weaker following the US employment report and this helped push the Euro weaker against the US currency with the relationship seen over the past few months still holding.

The dollar weakened sharply in US trading following a report that the Chinese authorities had called for the issue of global reserve policies and the introduction of a new reserve currency to be discussed at the G8 meetings next week

The US ISM index for the manufacturing sector rose to 44.8 in June from 42.8 the previous month which was marginally above expectations, although there was some disappointment that the orders index slipped back to below the 50.0 level which suggested an important risk that any recovery in the industrial sector will stall relatively quickly. The US Chicago PMI index was stronger than expected with an increase to 39.9 in June from 34.9 the previous month, although this still indicated a significant contraction in the manufacturing sector.

There was a surprisingly weak report for consumer confidence. The June Conference Board measure weakened to 49.3 from a revised 54.9 the previous month, disrupting the recent run of favourable consumer-related data.

The ADP report recorded a private-sector employment decline of 473,000 for June after a revised 485,000 drop the previous month. The headline US employment data was weaker than expected with a payroll decline of 467,000 for June following a revised 322,000 the previous month. The unemployment rate increase was slightly lower than expected with an increase to a 26-year high of 9.5% from 9.4%.

The secondary elements in the data continued to give significant cause for concern with a decline in weekly hours while the unemployment increase was held back by a decline in the workforce which will maintain fears over the income levels and consumer spending outlook. Jobless claims also remained above the 600,000 level in the latest week at 614,000.

The Euro-zone data recorded a rise in German unemployment to a two-year high, although the monthly increase was lower than expected. The flash Euro-zone consumer inflation estimate recorded a decline in the annual rate to -0.1% from 0.0% the previous month, the first ever annual decline

As expected, the ECB left interest rates on hold at 1.0% following the latest council meeting. Despite voicing concerns over the 2009 outlook, bank President Trichet was generally neutral in his comments over the economy and interest rates and his comments overall suggested that the bank is in a holding pattern to await further developments in the real economy. Trichet was keen to emphasise that the bank had prepared an exit strategy if there was any evidence of inflation risks.

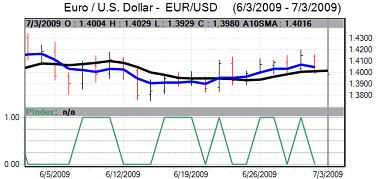

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

The Euro looked to secure net gains on the crosses during the week, but struggled to sustain the gains as underlying confidence in the economy remained fragile and it consolidated near 1.40 against the dollar.

Rallies in the Japanese currency quickly attracted selling pressure, although the yen still proved to be generally resilient as global equity retreated over the second half of the week and confidence faltered with consolidation in a 95.60 – 96.00 range.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

The headline quarterly Tankan index of business confidence improved to -48 from the record low of -58 recorded previously, which was a weaker improvement than expected. Companies were also more pessimistic over investment plans with capital spending expected to decline by 9.4% in the current fiscal year.

The manufacturing PMI index rose to a 1-year high, although it was still below the 50.0 level. There was a further small increase in the Chinese PMI releases for June which helped stabilise risk appetite, at least temporarily.

Sterling pushed to 8-month highs against the dollar in the first half of the week with a peak above 1.67 against the dollar, but failed to sustain the gains. There were negative press reports on the UK debt position while data releases were mixed. The UK currency was weaker against the Euro with lows beyond 0.86.

The UK PMI index for manufacturing rose to 47.0 for June from 45.4 the previous month, maintaining the recent tone of improvement with output expanding. In contrast, the construction PMI index for June weakened to 44.5 from 45.9 previously, ending the run of improvements seen over the past few months. The services index edged lower to 51.6 from 51.7.

The Nationwide bank reported that UK house prices rose for the second successive month in June which helped boost sentiment. In contrast, the GDP data was sharply weaker than expected with a revised 2.4% decline for the first quarter from a 1.9% estimate previously, the weakest performance for 50 years.

Business investment also fell sharply by 7.6% for the quarter, reinforcing the downward pressure on capital spending. The current account data was also weaker than expected with a GBP8.5bn deficit for the first quarter.