Markets struggled to secure direction for much of the week. The dollar was unable to make any great headway, but it did again show some resilience in the face of underlying weak sentiment.

The latest US capital flows report recorded net long-term inflows of US$11.2bn for April from US$55.4bn the previous month. There was a decline in US Treasury holdings by many central banks during the month and this will maintain underlying unease over the risk of reserve diversification away from the US currency.

The current account deficit narrowed to US$101.5bn for the first quarter of 2009 compared with a revised US$154.9bn the previous quarter. The deficit is narrowing at a substantial pace, but both figures were significantly higher than expected. A narrower structural deficit will still provide some degree of dollar protection.

The US currency gained some support from assertions by global finance officials that the dollar will remain the dominant international currency with Russian Finance Minister Kudrin the latest official to voice dollar support.

The US housing data was slightly stronger than expected with starts rising to an annual rate of 0.53mn for May from a revised 0.45mn the previous month. There was a strong rise in multi-family starts which helped push the total higher while building permits also edged higher.

The industrial data was weaker than expected with a 1.1% production decline for May while there was a decline in the capacity use rate to 68.3% from 69.1% previously.

The US Philadelphia Fed index rose to -.2.2 for June from -22.6 the previous month which was sharply stronger than expected and the highest reading for nine months. The data caused significant relief, especially as the New York manufacturing index released earlier in the week, had registered a monthly deterioration

Elsewhere, initial jobless claims edged slightly higher to 608,000 in the latest reporting week, from 605,000 previously while there was a decline in continuing claims which will boost confidence that the labour market is starting to stabilise.

US consumer prices rose by 0.1% in May compared with expectations of a 0.3% monthly increase while the underlying rate was in line with expectations with a 0.1% rise. The weaker than expected headline increase triggered the largest annual decline since 1950 of 1.3%. There were also reduced expectations that the Fed would consider an increase in interest rates which also tended to undermine the US currency.

There was a further rise in the German ZEW business confidence index to 44.8 in June from 31.1 the previous month which was the highest figure for three years. Companies were still pessimistic over current conditions which tended to offset the mood of optimism to some extent.

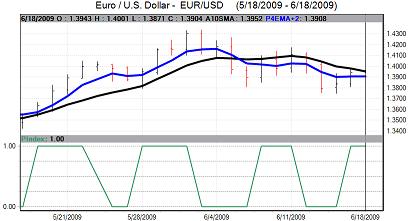

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

There were further concerns over the banking sector with reports that Euro-zone banks may need to announce debt write-downs of at least a further US$200bn. The Euro hit resistance above the 1.40 level against the US dollar.

The yen strengthened to test dollar support levels near 95 and also secured a firm tone against the Euro as capital outflows failed to trigger substantial selling pressure on the currency. The Japanese currency then edged lower to 96.80 on Friday.

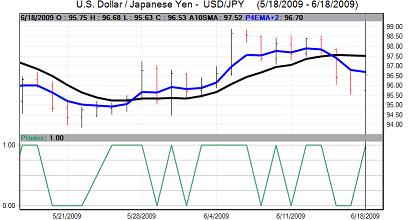

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Following the latest council meting, the Bank of Japan left interest rates on hold at 0.10%. The bank also upgraded its view of the economy.There was an improvement in the latest Tankan monthly survey and expectations of stronger Chinese growth which helped underpin confidence.

The latest capital account data also continued to record net outflows from Japan in to higher yield markets while the latest fund launches have attracted strong investor support. In this environment, there was still evidence of yen selling on rallies.

The UK unemployment claimant count rose by 39,300 in the latest monthly survey after a revised 49,600 increase the previous month which was a significantly slower increase than expected even though the unemployment total was at a 12-year high.

The inflation rate was higher than expected with the annual CPI rate only declining to 2.2% in May from 2.3%, maintaining the trend of higher than expected numbers. The higher than expected rate increased pressure for the Bank of England to resist a further expansion of quantitative easing. Although still very cautious, Bank Governor King was slightly more optimistic in his comments on Wednesday.

Other data was weaker than expected with a 0.6% reported decline in retail sales for May to give a 1.6% annual decline which was substantially weaker than expected. The latest monthly government borrowing data registered a record monthly deficit of GBP19.9bn. The latest bank lending data was also weak as lending remained under pressure while the CBI industrial survey remained near record lows.

Sterling was subjected to frequent bouts of profit taking during the week. From peaks above 1.65 against the dollar and beyond 0.8450 against the Euro, it ended off its peaks even though the underlying tone was still robust.

At the latest policy meeting the Swiss National Bank left interest rates on hold at 0.25% which was in line with expectations. The bank confirmed that it would resist a franc strengthening while the corporate bond purchases would continue.

The bank expressed satisfaction with the policy effectiveness so far and the threat of further action will continue to limit the scope for franc gains.

Following the council meting there were rumours of fresh intervention to weaken the currency with reports that the BIS was buying Euros against the Swiss franc and the Euro strengthened to highs above 1.5120 from near 1.50 with the dollar near 1.0850.