Degrees of risk appetite continued to have an important market impact. Confidence initially faltered with fears over the impact of a flu pandemic, but economic sentiment was generally resilient as equity markets were generally firmer and this lessened dollar demand. There were also no major global negative data surprises

The US GDP data was weaker than expected with a headline 6.1% annualised contraction for the first quarter of 2009 following a 6.3% decline the previous quarter. Inventories continued to decline sharply during the three-month period while trade volumes also fell rapidly in response to the global downturn. The sharp drop in inventories should lessen the risk of a further very sharp GDP contraction.

The latest US initial jobless claims data was close to market expectations with a decline to 631,000 from a revised 645,000 the previous month while continuing claims were at a fresh record high at 6.27mn.

In contrast, the Chicago PMI index was stronger than expected at 40.1 from 31.4 the previous month as orders recovered. The Chicago data should act as a leading indicator and the firmer data maintained some cautious optimism that the economy was in a position to recover and the National PMI index also strengthened.

The other more forward-looking data maintained the recent pattern of being stronger than expected with consumer confidence rising to 39.2 in April from a revised 26.9 previously, although this is still at an historically very weak level.

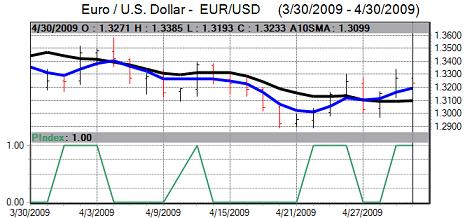

The dollar weakened ahead of the FOMC interest rate decision on expectations that the Fed would expand the quantitative bond buying to help support the economy. With risk appetite also firmer on higher equity markets, the dollar weakened to lows near 1.3340 against the Euro.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

As expected the Fed left the target range for Fed funds at the 0.00 – 0.25% range following the latest FOMC meeting. The Fed also decided not to adjust the amount of bond buying at this time. In the statement, there was a commitment to keep interest rates at a very low level for an extended period. There was, however, some cautious optimism that the rate of contraction in the economy was slowing.

The Euro-zone employment data was weaker than expected with the unemployment rate rising to 8.9% from 8.7% the previous month. The flash inflation estimate for April was also slightly lower than expected at 0.6%. German unemployment rose by a further 58,000 in the latest month from a revised 71,000 increase the previous month. There was speculation that the Irish economy could contract by at least 10% for 2009.

There were further comments from ECB officials during the week with Bini-Smaghi, for example, casting doubts whether there had been an agreement on quantitative easing methods. The Euro remained very sensitive to policy comments ahead of the council meeting next week and suggestions that the bank would not pursue quantitative easing underpinned the Euro. Late in the week, there was an agreement that ECB members would not make public comments over policy measures.

The Euro secured solid buying support on retreats and pushed to a high above 1.33 against the dollar, although it was unable to make strong headway as resistance levels remained tough to break down.

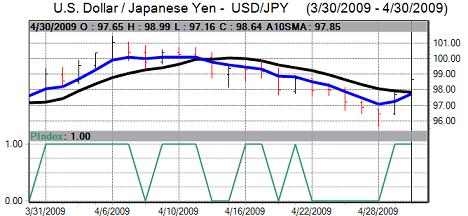

The Japanese currency gained ground early in the week as economic uncertainties combined with fears over the flu outbreak undermined risk appetite. The Japanese currency strengthened to highs beyond 96 against the dollar and 125 against the Euro before weakening sharply later in the week with lows beyond 99 against the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Japanese industrial data was stronger than expected with a 1.6% increase in industrial production, the first rise for eight months, which boosted confidence in the domestic and regional economy.

The Bank of Japan held interest rates at 0.10% following the latest council meeting and also decided against implementing any further quantitative policy measures.

The UK economic data was stronger than expected with the CBI retail survey rising to +3 from -44 previously, although this figure is likely to have been distorted by seasonal considerations and the CBI was still generally downbeat over prospects. The data still provided some degree of net relief and alleviate fears over a further substantial deterioration in retail spending.

Hometrack reported the slowest decline in house prices for close to 12 months with a 0.3% April monthly drop, but was not confident that any recovery would be sustained. There was a small decline in BBA mortgage approvals for March which caused some disappointment given that the recent housing-sector evidence has suggested a very tentative recovery in lending levels while mortgage lending was also weak.

The PMI manufacturing index rose to 42.9 in April from a revised 39.5 which was an 8-month high.

Sterling proved generally resilient over the weak as underlying UK economic fears were offset by optimism over risk appetite. The UK currency pushed to near 0.8900 against the Euro and tackled tough resistance above 1.49 against the dollar.

The commodity currencies secured robust gains over the week with the Australian currency strengthening to above 0.73 against the US dollar while the Canadian dollar strengthened to 1.1830.