Currency markets struggled for direction during the week as a whole with no currency in a position to gain strong buying support. The dollar proved generally resilient and there were bouts of strength, but it struggled to make significant headway. Underlying confidence in the US fundamentals was weaker while defensive demand for the currency was generally weaker. Libor rates fell significantly which suggested that dollar supply was improving and this curbed support for the currency.

The US retail sales data was weaker than expected with a headline decline of 0.4% for April while there was a core 0.5% decline. There was caution given the monthly volatility in data, but there were some fears that consumer spending will remain under pressure which would also tend to stifle any recovery in the economy as a whole.

Initial jobless claims were higher than expected with a rise to 637,000 in the latest week from a revised 605,000 the previous week. The data will maintain unease over the labour market, especially as the data has been showing some signs of improvement. Continuing claims also pushed to a fresh record high of 6.56mn for the week. The impact was, however, offset by the fact that much of the weekly increase in initial claims was due to layoffs related to Chrysler’s bankruptcy.

The US trade deficit was slightly lower than expected with an increase to US$27.6bn for March from a revised US$26.1bn the previous month. There was a further decline in exports and imports with exports declining by 17.4% over the year while imports registering a sharp 27%.annual decline. Long-term capital flows rose to US$58bn for March which provided some support to confidence.

The US federal budget recorded a deficit of US$20.9bn for April compared with a US$159.3bn surplus for the equivalent month last year. This was the first deficit for April since 1983, reinforcing the severe underlying deterioration seen over the past year and the need for huge debt issuance over the next few months.

The Euro-zone industrial data was weaker than expected with a 2.0% decline for March following a 2.3% fall the previous month and this gave an annual decline of over 20%. German GDP fell by a record 3.8% for the first quarter.

ECB council member Kranjec stated that the central bank could increase the asset purchase scheme which also unsettled the Euro to some extent while fellow member Weber was also generally downbeat over recovery prospects, although Weber also rejected additional bond buying.

There was further evidence of underlying tensions within the ECB as a series of officials continued to make contradictory comments on monetary policy. Markets were looking for bank President Trichet to take a tough stance on the council members and agree on a consensus line.

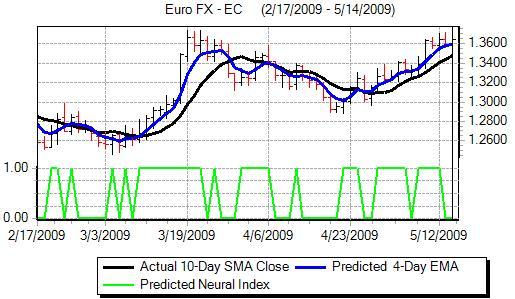

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Euro struggled to secure significant gains over the week, but it resisted heavy losses as all the major international currencies struggled to secure strong support and held above last week’s support levels, consolidating above 1.35 on Friday.

There was a greater focus on the schedule of Treasury bond coupon payments with heavy payments due over the week. Fears that the capital would be repatriated back to Japan was significant in curbing dollar support. There was also speculation that there could be stop-loss selling of aggressive short yen positions which had been built up.

The Japanese currency strengthened over the week with highs near 95 against the dollar and beyond 130 against the Euro.

The UK economic data generally offered support for Sterling during the week. The BRC reporting a 4.6% annual increase in retail sales, although this was probably distorted by the timing of Easter. The latest RICS survey also continued to record an underlying improvement in the housing sector as the pace of price declines slowed.

The other UK data was also stronger than expected with a decline in the goods trade deficit to GBP6.6bn for March while there was a smaller than expected manufacturing production fall of 0.1%, the slowest rate of decline for 13 months. The headline claimant count data was also better than feared with unemployment rising by a further 57,100 in April. Although the ILO unemployment rate was higher than expected with an increase to a rate of 7.1% from 6.7%.

The Bank of England inflation report again had an important impact on Sterling, maintaining the recent trend of high volatility following the quarterly reports.

The bank warned in the report that the recession was liable to be deeper than expected while the recovery would be protracted and slow given the underlying stresses within the economy. The projected inflation rate was 1.0% in two years time which suggested that the bank will not be looking for an early increase in interest rates. There were no substantive comments on the quantitative easing programme as the bank stated that it will need several months to assess how effective the policy is.

Sterling pushed to challenge 2009 highs above 1.53 against the dollar, but was unable to sustain the gains and weakened slightly over the second half of the week. Sterling found support above 1.50 against the dollar and beyond 0.90 against the Euro.

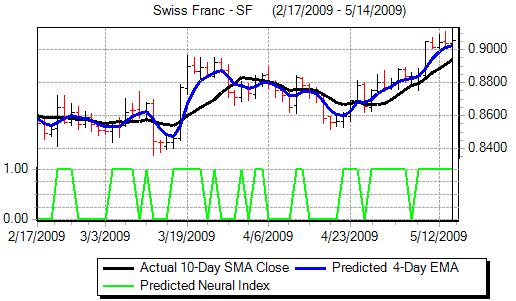

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Swiss franc remained resilient during the week, resisting selling pressure against the Euro while it also challenged dollar support levels close to 1.10 with the dollar finding firm support close to this level.

National Bank member Jordan again warned that the bank wants to prevent further appreciation, maintaining the recent barrage of comments from officials. He also took a generally downbeat view on the short-term outlook with a waning that the economy was likely to return to growth in mid 2010 at the earliest.