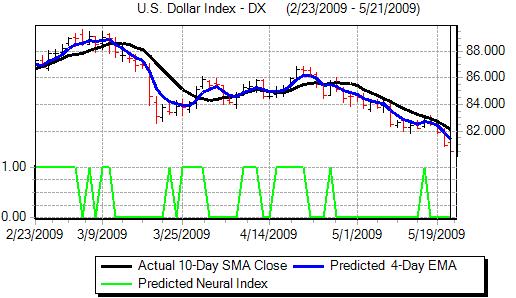

An important feature of the week was a significant deterioration in confidence surrounding the US dollar. It failed to make any impression against the major currencies early in the week and then weakened sharply with the trade-weighted index dipping to 5-month lows as there was substantial selling pressure on the currency.

The Libor fixing rates recorded a sharp drop in 3-month dollar rates to 0.66% from 0.83% last week while the TED and Libor-OIS spreads also continued to narrow to 15-month lows. Libor rates have fallen consistently during May from levels above 1.0% and the decline indicates that there has been a significant easing of stresses.

Any sustained improvement in conditions would suggest increased dollar supply in markets and reduced demand for the currency. This combination would certainly tend to limit the scope for dollar gains and increase the risk of selling pressure.

The US housing data was weaker than expected with starts falling to an annual rate of 0.46mn for April from a revised 0.53mn the previous month. This was a record low for the series and building permits also fell to below the 0.50mn level. Starts were dragged lower by notable weakness in the apartments sector and single-family starts were more robust which will help cushion the impact of weak headline data.

The Philadelphia Fed index improved to -22.6 in May from -24.4 the previous month, but there was some disappointment that there was not a bigger improvement. Similarly, initial jobless claims only fell to 631,000 in the latest week from 643,000 previously while continuing claims increased to a fresh record high at 6.66mn.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

There was significant selling pressure in US Treasuries due in part to unease over the medium-term debt and inflation outlook as the massive US debt issuance continues. Following the Standard & Poor’s warning over the UK debt rating, there were some fears over the US rating which undermined the dollar.

Within the FOMC minutes, the Fed forecast a deeper GDP contraction for 2009 and also lowered the 2010 growth forecast. The Fed members also discussed increasing the quantitative easing programme at the meeting which was another factor in undermining sentiment towards the US currency.

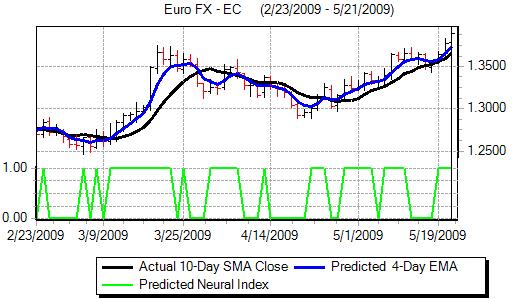

The German ZEW index rose to 31.1 in May from 13.0 the previous month which was the seventh consecutive increase. The ZEW institute was generally optimistic that the economy was recovering. The ZEW still warned that the recovery could be weak and that its pattern was uncertain which created some caution.

The Euro-zone PMI indices continued to improve with most country indicators at an eight-month high with the manufacturing index rising to 40.5 from 36.8 previously. The rise helped reinforce expectations of a measured Euro-zone recovery.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The Euro was generally hesitant on the crosses over the week and lost ground against Sterling, but wider dollar weakness was crucial in allowing a rally to highs close to 1.40 against the US currency.

The yen proved generally resilient during the week and was able to limit losses against the main European crosses. With the dollar under wider pressure, the Japanese currency strengthened to highs just beyond 94 against the dollar. There were strong gains for the Canadian dollar over the week.

The UK CPI inflation rate fell to 2.3% in April from 2.9% with a -1.2% rate for the RPI as the sharp cuts in interest rates put downward pressure on housing costs. The inflation data was slightly below expectations, although the impact was limited.

The Bank of England minutes recorded a 9-0 vote to keep interest rates on hold at 0.50% and to increase the quantitative easing programme by a further GBP50bn. There was a debate as to whether there should be an even more aggressive programme of bond buying which unsettled Sterling to some extent.

The latest CBI industrial survey recorded a further very weak reading for the orders component at -56 from -57 the previous month. The output reading was more positive which maintained hopes that the sector is stabilising.

The UK retail sales figures were stronger than expected with a 0.9% monthly increase for April while the increase for the previous month was revised up to 1.1%.

The impact was overshadowed by the Standard & Poor’s announcement that the UK credit rating was being put on negative watch due to budget and debt fears. The AAA rating was maintained for now which will helped lessen the impact while other agencies did not suggest that they were considering further action.

The underlying budget data also remained weak with a GBP8.5bn borrowing requirement for April following a GBP18.2bn shortfall previously which reinforced market fears over the debt situation.

A key feature was Sterling buying support on dips and there were significant gains to 2009 highs near 1.59 against the dollar despite sharp selling pressure at times. The UK currency also secured net gains against the Euro even with a sharp retreat from a peak near the 0.87 level.