Still Limited Within Its Daily Rising Channel.

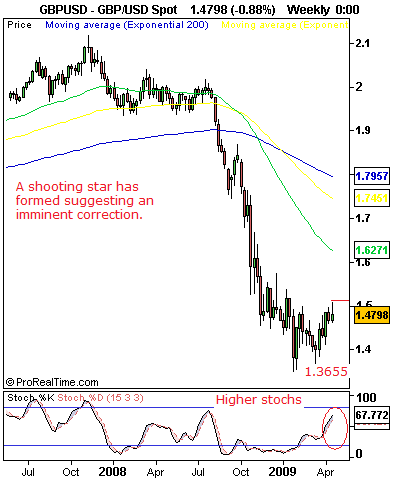

GBPUSD- Although failure at 1.5066 high pushed GBP to the downside on Thursday and Friday, it still posted a higher close at 1.4795, forming a shooting star candle. We maintain that while the pair continues to hold within its daily rising channel and above its key support at the 1.4662 level, its Feb 23’09 high, a return above its Jan 16’09/Feb 09’09 highs at 1.4981/86 is expected with the next upside target coming in at the 1.5066 level, its April 16’09 high and then the 1.5374 level, its Jan 08’09 high. The weekly stochastics is positive and advancing suggesting further strength. The risk to this analysis remains the highlighted shooting candle pattern. However, if the pair follows through on its shooting star candle formation and pushes below the mentioned rising channel then the 1.4662 level will be targeted with a break and close below there putting it in position to head towards the 1.4305 level, its Mar 06’09 high and later the 1.4111 level, its Mar 30’09 high. All in all, with its daily rising channel still valid and holding above the 1.4662 level, GBP continues to maintain its nearer term upside outlook.

Directional Bias:

Nearer Term -Bullish

Short Term –Bearish

Medium Term –Bearish

Performance in %:

Past Week:: 1.15%

past Month: +0.31%

Past Quarter: -1.86%

Year To Date:: 01.28%

Weekly Range:

High -1.5066

Low -1.4603

This is an excerpt from FXT Technical Strategist Plus, a 7-currency model analysis. Take A One Week Free Trial at www.fxtechstrategy.com

This report is prepared solely for information and data purposes. Opinions, estimates and projections contained herein are those of FXTechstrategy.com own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which FXTechstrategy.com incurs any responsibility. FXTstrategy.com does not accept any liability whatsoever for any loss arising from any use of this report or its contents. This report is not construed as an offer to sell or solicitation of any offer to buy any of the currencies referred to in this report.