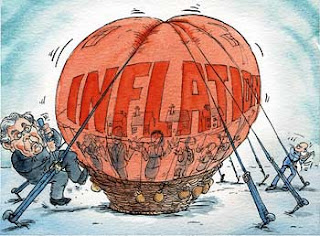

US stock futures are once again set for a nearly flat open after a mixed session yesterday. Whereas Monday saw little in the way of economic numbers, Tuesday we have a busy calendar of data on tap. China and the UK already reported rising inflation overnight, actually a positive thing for stocks. Since interest rates are not going up, top-line inflation lures money into the stock market. Also on the docket is January retail sales, the Empire State Manufacturing survey, business inventories and the NAHB housing market index.

Yesterday the blue chips closed narrowly in the red but the S&P and Nasdaq eked out gains. However, there was certainly stock specific action that made headlines. Netflix, Inc. (NFLX) had a monster day, squeezing shorts on its way to a 7% gain.

NFLX has pulled off a bit overnight. Google, Inc. (GOOG) continues to play catch-up in the tech group and feels like its only a matter of time before it gets back to highs above $640. Agricultural stocks continue to fulfill their promise, extending higher and proving Cargill’s decision to unload its stake in The Mosaic Company (MOS) was foolish.

Check out Scott Redler’s Daily Price Point sheet and watch the Morning Call video below.

Cloud, Bank Stocks that Can Play Catch-Up

As the market continues to stay extended and somewhat overbought, it is going to be hard to continue buying the strongest stocks for further extensions. When the highest fliers start to get tired, it’s time to look down the line at stocks that may be lagging a bit, says Marc Sperling of T3Live.com

The cloud computing sector has seen a roller coaster start to 2011, with weak guidance from F5 Networks, Inc. (FFIV) triggering the latest debacle in the sector. Many cloud stocks have recovered nicely from that impulse drop, including the likes of Rackspace Hosting, Inc. (RAX) and Riverbed Technology, Inc. (RVBD) which have broken out to new highs.

One name that used to be the unquestioned leader in the group but is now lagging a bit is VMWare, Inc. (VMW). The virtualization leader is breaking out of a slower uptrend, and above $91 VMW has nothing in the way of getting back to highs.

In the banking group, JP Morgan Chase & Co. (JPM) has become the clear leader after a strong earnings quarter, while former leader Goldman Sachs Group, Inc. (GS) continues to sputter. Despite a weak quarter, we still believe the Goldman crew are the best in the business. If the stock breaks above $168.70 you can look to add for a move back to highs around $175.

Solars Rising

From a long-term investors perspective the solar group is a little bit iffy. Some hype solar energy as the next great green energy source, while others have concerns about the efficiency and viability of solar power. All that aside, the solar group often acts well technically and is perking up after a recent pull-back. In keeping with the laggard theme, there is a solar stock that looks poised to play catch-up.

First Solar, Inc. (FSLR) is the leader in the solar group, breaking out to highs over the last two trading days. Suntech Power Holdings Co., Ltd. (STP) has seen a nearly 10% pop over the past two days , but is still sitting below pivot highs. Above $9.50 the stock should run at least to the next pivot around $10.25.

Gold and Silver Setting Up

Rising inflation numbers from the UK and China have provided the catalyst this morning for a jump in precious metals. The SPDR Gold Trust ETF (GLD) is gapping more than a dollar to $134, while silver is opening up near all-time highs. Each metal provides a different kind of trade, silver has outperformed and is set to breakout, while gold has room to run to highs.

Scott Redler of T3Live.com says gold has been giving buy signals since the wide-range reversal on January 28. The more confirmed entry was on February 3 as the fund broke the descending channel that started on the first trading day of 2011. GLD is gapping up out of a recent tight consolidation, and still provides a great entry as inflation heats up.

*DISCLOSURE: Scott Redler is long JPM, GS, GLD, GOOG. Marc Sperling is long SLV, GLD, WFC, AGQ, JKS, VMW. John Darsie is long JPM, GS, GLD, SLV, GDX, RAX, RVBD, MOS.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.