Everyone seems to believe Treasury bonds are going down due to the lack of demand, specifically by the Fed. The ‘taper’ is the cause, a gradual cutback of bond purchases by the Fed that is expected to completely wind down later this year. Of course, rates are still low and will remain rock bottom for some time to come, because inflation is nascent. The Fed is not only trying to stimulate growth and help create jobs (by boosting confidence), they are also trying to fight off deflationary fans that always seem to threaten to unwind the goodness of the recovery – now about five years old.

But contrary to what we know from textbook economic definitions of supply and demand, the reduced purchases by the Fed won’t necessarily cause bond yields to jack up. First, there are other buyers out there who find U.S. treasuries a safe haven. It is these buyers who will continue to bid for bonds in a non-inflationary environment. And therein lies the answer to yields: unless there is some inflation in the system, we won’t see higher yields.

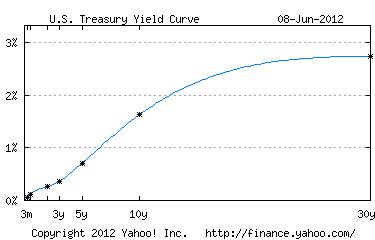

As long as there is some growth, the term structure of rates will slope upward (modestly). See the curve below. However, we could see yields rise and steepen the curve substantially with the presence of ‘some’ inflation and perhaps higher growth, what the Fed is looking for. Vice Chairman of the Fed Bill Dudley sees at least 3% growth in 2014 for the U.S. economy. Last week’s GDP quietly showed some rising prices in the data, nothing serious but it was certainly notable. As I mentioned recently on Jim Cramer’s Mad Money ‘Off the Charts’ segment, we may see yields start to rise over the coming months — not due to taper but due to a stronger economy and a little inflation. The Fed’s playbook!