Growth names have been running higher for a while, but there are still opportunities if you’re discerning. Zillow.com (Z), a provider of online real estate services, has a savvy CEO in Spencer Rascoff.

MAKING MONEY

The company turned its first annual profit last year, and it’s also one of the few Internet IPOs that’s monetizing mobile. The company says more homes are now viewed via Zillow on a mobile device than on a desktop. In early August, Zillow reported profit of $0.04 a share. Sales rose 75% to $27.8 million. Full-year profit is expected to soar 228% this year to $0.32 a share (compared to 2011) and 128% next year to $0.73 a share.

BUYERS STORMED IN ON DIP

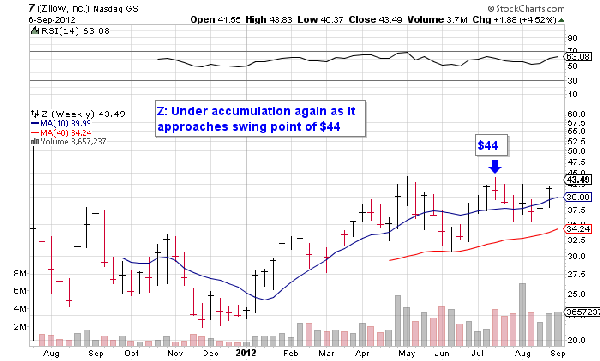

Late Wednesday, Zillow announced a secondary offering of nearly 3.2 million shares. Shares hit an intraday low of $40.92 but buyers stormed in late and Zillow closed at $43.49, up 2.5% and just below a swing point (buying area) of $44. Volume was huge at 2.3 million shares, well above its average daily volume of around 670,000 shares.

BUY LEVELS

It’s pretty straight forward at this point. I’ll wait for Zillow to take out its current swing point of $44 in heavy volume. If it does, the stock would be buyable. Another scenario is that Zillow drifts lower from here and forms a handle area in light volume. If it does, an entry point below $44 could be seen.

Follow me on Twitter @kenshreve for additional market updates about Zillow and other emerging leaders.