The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!

Today’s Golden Sunrise

Friday, May 07, 2010

Hours of daily research consolidated for you

What Sort of Day was it?

The late Walter Cronkite hosted a television show decades ago that recreated historical events…youtube has many…and he ended each broadcast with (with his wonderful voice and intonation)

“What sort of day was it? A day filled with the events that alter and illuminate our time. And you were there.”

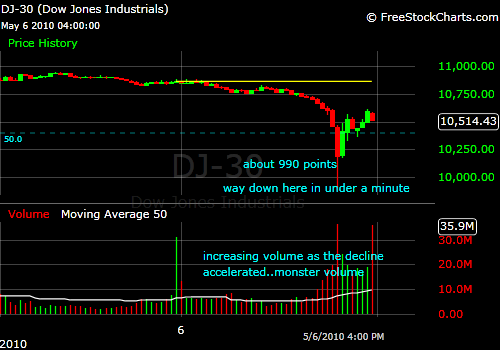

Yesterday may well have been a day that qualifies. Watching my screens, day was down…glanced at CNBC which had the area in front of the Greek parliament buildings on camera..crowds, helmet and shield security forming a barrier…announcer as part of routine chatter said it was about 9:30 in Greece..when the phalanx began to move forward to disperse the crowd..a man in a bright yellow shirt rushed forward into the formation and earned a baton to the head for this daring…anyone who didn’t flee received a similar response..as this happened the market start down..sharply and dramatically.. moving back to my screens..all of 10 feet…I put on some trades..a couple of sells on illiquid shares that had a bid sitting there..and a nice buy on a stock I owned and caught near its panic bottom..I glanced at the Dow it was now down 616…did a couple of other things with trades…Dow was now .415..then 315-the near 200..then 400.. amazing stuff…this is about 10 minutes..

Later, you are hearing about “fat fingers”, program trades, and all sorts of things..yesterday, I wondered about where the support levels are…hit some 200 days averages and had some bounces…we’ll see today…I am sure the trades have all been reset…990 points on the Dow…amazing…the charts are just incredible..

At the same time while all this was happening: these silver dollars probably got more valuable…could buy them for $15-17 bucks a couple of years ago…$20-22 probably decent price now..they don’t care about the unemployment report or the ECB action.

I recommend having some…the dollar on the left is a Morgan silver dollar-issued between 1878-1904 and the year 1921. The dollar on the right is known as a Peace dollar and was issued between in 1921-1928, then 1934 and 1935. Silver dollars were issued by mints in Philadelphia, Denver, San Francisco, New Orleans and Carson City. Some are very rare and very costly in any condition…the date; the mint mark and the condition are the determinants of collector value.

Generally, most are pretty common (to collectors) and general show some wear from usage so you can buy them without much concern so you then own something that has silver as its’ primary price determinant. US silver dollars, when new, hold .7734 ounces of silver which was issued based on silver valued at $1.293. A dollar was a dollar.

Buy one-put the purchase price in dollars in one hand, the silver dollar in the other and ask yourself which one you prefer to have 3 years from now, 5 years, 10 years..try this test with anyone. And take action on the answer.

Let’s look at some charts: the Dow on a 10 minute chart.

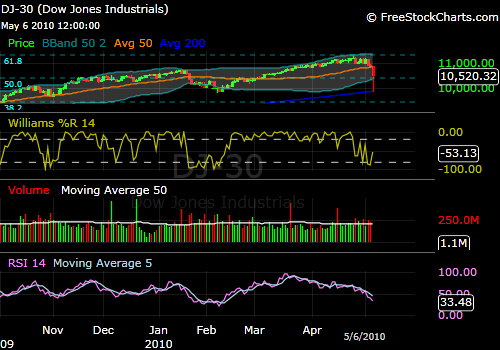

The Dow on a daily chart: shattered the 50 day, touched the 200.

Chart after chart all have the same general shape.

Counterfoil US Dollar:

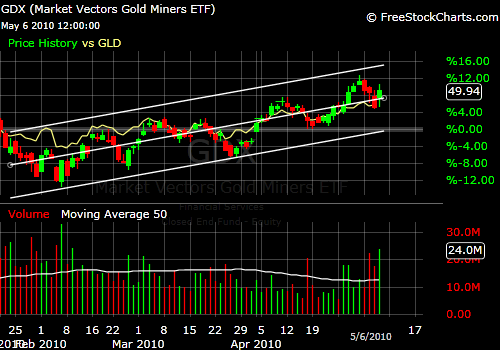

Gold: talking head talk was all about gold’s currency status. I don’t like it when the TV folks talk about things I am interested in. But, if there is such a thing as a flight to safety…price and volume explosion tells you found one destination.

The GDX with the gold comparison line..good day yesterday.. higher highs and higher lows usually means continued uptrend. Long way to hit the upper channel trend line…

- As a group, gold stocks (on IBD) moved from 141 to 122. It was one of two groups that were positive yesterday, the other being Funeral and Related Services.

- As an index, Gold stocks were the only positive among 23 listed, 2nd number daily performance this week..next best was -2.25 while gold stocks were up 1.3%

- Open interest on the futures is up to 552,683 contracts highest in at least months and higher than the run to $1220 in gold

Asia got crushed last night except for Sri Lanka and the Bangladesh markets. Some real comfort there.

European markets are down 30-40 points but much better than earlier.

US futures are green, the Dow up 56..

Jobs report at 8:30-don’t think it matters unless it is horrible.

64% of NYSE stocks are above the 200dma (which is why it is now the key level) this was 88% on April 15 and 83% yesterday!

Short ratio declined yesterday to 11.12% from 11.57% day prior

Volume was huge…enough to be capitulation?

What will today bring?..a day like all days-filled with events. Perhaps not as much panic as yesterday…

Act in your own best interest.

JohnR.

Goldensurveyor.com