US stock futures are close to flat this morning after yesterday’s emotional roller coaster. Investors are trying to regain their balance after an enormous pre-market down overnight and then bounce during the session that erased more than half of those overnight losses. The major concern continues to be the nuclear crisis in Japan, where radiation has leaked from several reactors at the Fukushima Daiichi plant, which is still in danger of full on nuclear meltdown. Until that situation becomes more stable, it is difficult to envision the market taking off higher. Also to consider is increasing violence in Bahrain, which has been largely ignored due to the Japan earthquake. Violence is spreading throughout the country, and the Saudi military has even entered to quell some of the unrest.

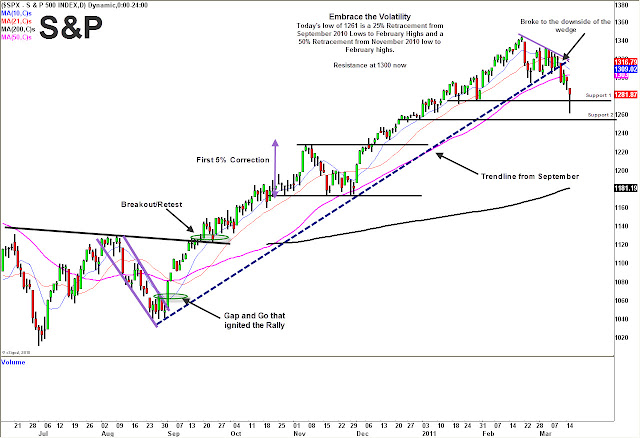

With the market starting to repair itself, it’s time to start looking at important levels in the S&P. Big support for the index was around 1275, which we opened below yesterday before rallying back above, thus negating some of the significance of the break. Right now, you should be watching resistance in the area of 1290-1300, the area of the secondary breakdown after the wedge resolved to the downside. Perhaps the market can drift higher into that area, but there will likely need to be more clarity from Japan before we blast through that level.

For more stock and market commentary, watch the T3Live.com Morning Call with Scott Redler, below.

Select Tech Leaders Acting Strong

As far as individual stocks are concerned, many were able to go positive yesterday despite the market only taking back a little more than half of overnight losses. Early on, we looked for stocks to buy that had gapped down smaller or that held support levels overnight. On the extreme end of that spectrum was Netflix, Inc. (NFLX) which actually opened higher after an upgrade from Goldman Sachs. The stock was a monster all day, breaking above both its 21 and 50-day moving averages. It should see more upside, but would be more compelling with some rest or a slight pull-back.

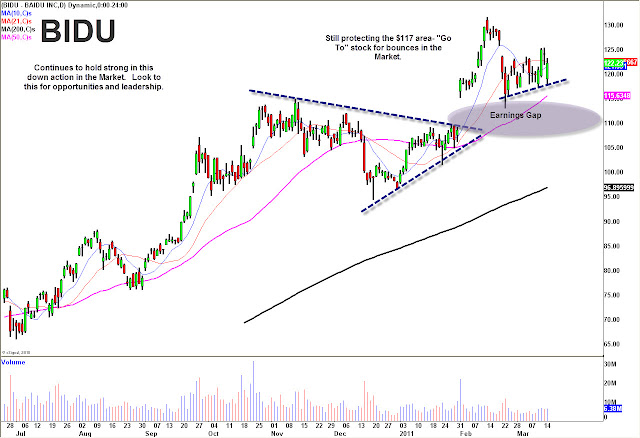

Another tech stock that wasn’t quite as strong, but held above the lower trendline of a recent consolidation was Baidu.com, Inc. (BIDU). The Chinese search giant, after another encouraging earnings quarter, ran to new highs above $130 before pulling back in the $120 area. Yesterday it couldn’t fill its entire gap down, but we expect it to get back to pivot highs around $125 before eventually making new highs above the $130 area.

OIHs Hold Up Well

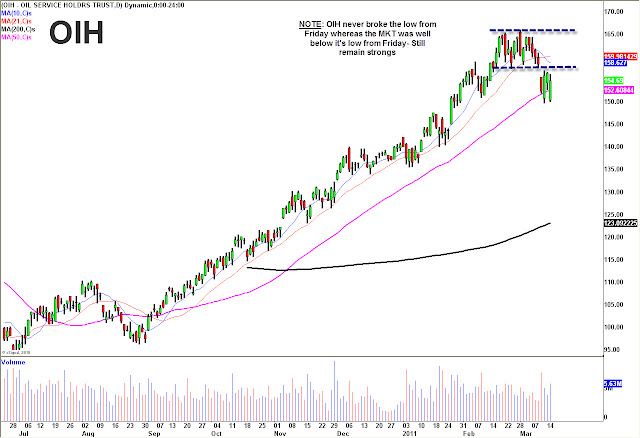

Another area that held up well over the last few days is the Oil Service HOLDRs ETF (OIH). The OIH actually never breached Friday’s low, while the market is trading well below that level still. Oil prices have come off hard due to the Japan earthquake, which will presumably hurt demand. However, the oil service stocks have not pulled off as hard, and it feels like the OIH can easily get back to highs over the next few weeks.

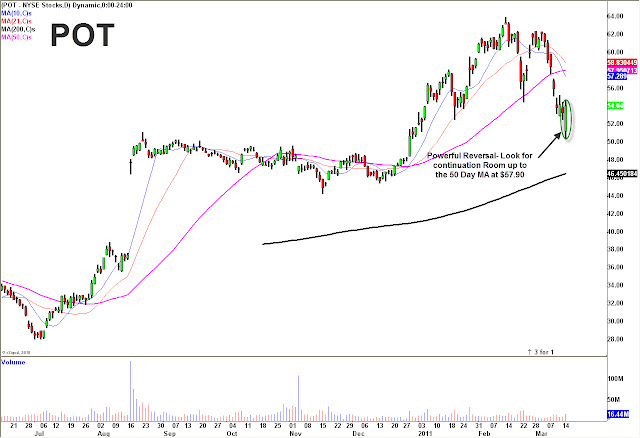

Too Late to Catch Potash, Freeport Bounce?

Two other stocks that had been in the doghouse over the last few weeks, but rebounded extremely well yesterday, were PotashCorp./Saskatchewan (POT) and Freeport-McMoran Copper & Gold Inc. (FCX). After such strong bounces yesterday, traders and investors may wonder whether they missed the boat, but we don’t believe that is the case with these stocks considering where they came from. Both are extending higher pre-market, and have plenty of room back to highs. Copper, gold and fertilizers all have strong fundamental stories as demand is rising for each, and we feel it was largely profit taking that sent these stocks tumbling. The best investors spot opportunity amidst weakness, and this could be a great example.

Chipotle Chart Looks Delicious

Marc Sperling of T3Live.com looks for relative strength in a down tape to determine what he will trade. One stock that fits that bill in his mind is Chipotle Mexican Grill, Inc. (CMG). Chipotle has barely gotten hit with the market over the past few days, holding in a tight mini-uptrend. Yesterday, as the market bounced during the session, CMG pushed toward the top end of that recent range, and looks set to break through the $260 area back to new highs around $275. From a fundamental perspective, Chipotle has seen tremendous growth in the United States, but the foreign markets remain relatively untapped for the maker of outstanding burritos. Another stock Sperling likes today is Youku.com, Inc. (YOKU), which is forming a nice upper level bull flag. A break above the $46 area should trigger a move back to new highs around $50.

*DISCLOSURE: Scott Redler is long POT, X, AAPL, GLD, F, V, SLV, NYX, RIMM, AMZN; Short SPY

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.