By FXEmpire.com

Whats Up With Silver or Should I Say Down

Earlier this week silver tried to cover positive territory, but as has been the case recently, glimmers of hope were short-lived. In a report, Marc Ground, Research Strategist for Standard Bank, wrote that we are waiting for the metal to drop closer to $30/oz. It appears that market participants are also increasingly shedding positive sentiment for the metal and are shying away.

Commodity Futures Trading Commission (CFTC) data released on March 19 revealed another week of declining open interest for COMEX silver. It was the biggest loser among the precious metals, losing 5.2 percent for the week. ETF investors hit their sell buttons, dropping 20 tonnes of silver, and the metal capped off last week down $1.60.

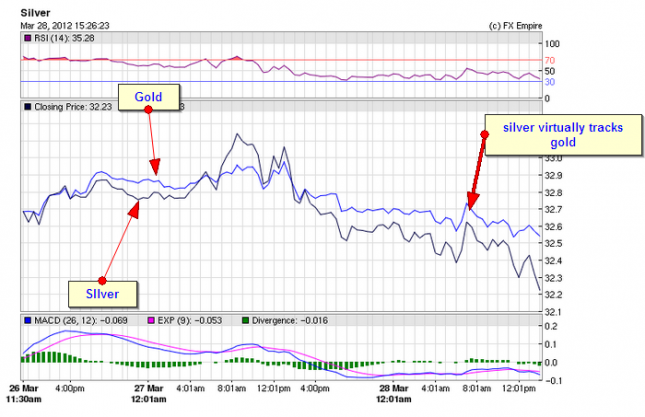

Monday, the metal was able to recover some of the previous week’s losses as it was a day of a weak US dollar, declining US treasuries, and strong crude but silver prices are now sliding back down. May silver declined 20 cents, or 0.6%, at $32.43 an ounce.

One might have assumed announcements that India is eliminating duties on silver would have provided some support, if not a boost to the market, but the news appears to be of little interest to participants thus far.

Two regions whose news did grab the silver market’s attention are the US and the Eurozone.

Orders for big-ticket items rose 2.2% in February, government data showed Wednesday, reflecting broad strength in demand across most U.S. industries. The Durable Goods report showed an increase but below that of forecast.

Economists surveyed expected durable-goods orders to increase a seasonally adjusted 2.9%, snapping back from a sharp drop in January. It was the fourth increase in five months.

Euro area countries are strongly considering paying cash into the currency union’s firewall faster in order to raise its ability to lend money to countries in trouble, a senior European Union official said Wednesday.

The British economy contracted 0.3% in the final three months of 2011 compared to the previous quarter, the U.K. Office for National Statistics reported Wednesday. The ONS had previously estimated a 0.2% quarterly contraction.

The UK’s current account deficit narrowed in Q4 following a sharp downward revision to the shortfall in the previous quarter, figures from National Statistics revealed Wednesday. The current account deficit narrowed to GBP8.451 billion in Q4 from GBP10.515 billion in Q3, in line with the median forecast. Revisions to UK investment abroad data meant that the Q3 shortfall was revised lower from an initially estimated GBP15.226 billion figure.

A broad measure of annual money supply growth across the 17-nation euro zone picked up speed in February, but the pace of lending to the private sector fell, the European Central Bank reported Wednesday. M3, the broadest measure of money supply

Reduced growth or manufacturing translates into an outlook for shrinking demand for industrial commodities. Silver came under pressure with other industrial resources such as copper, platinum and crude, and prices slid.

Gold tumbled today, after trying for two days to break the 1700. Psychological level, gold fell by $9, or 0.5%, to $1,675.80 an ounce on the Comex division of the New York Stock Exchange.

The metal shot higher earlier this week after Federal Reserve Chairman Ben Bernanke signalled U.S. interest rates would remain at current ultra-low levels for a few years.

It ended modestly lower on Tuesday, however, after being a few dollars away from the psychologically important $1,700 an ounce.

Originally posted here