Crude oil prices have been dropping consistently for six months. After our latest consolidation over a couple weeks in December, prices are on the move lower again.

So how can we know when this will turn around?

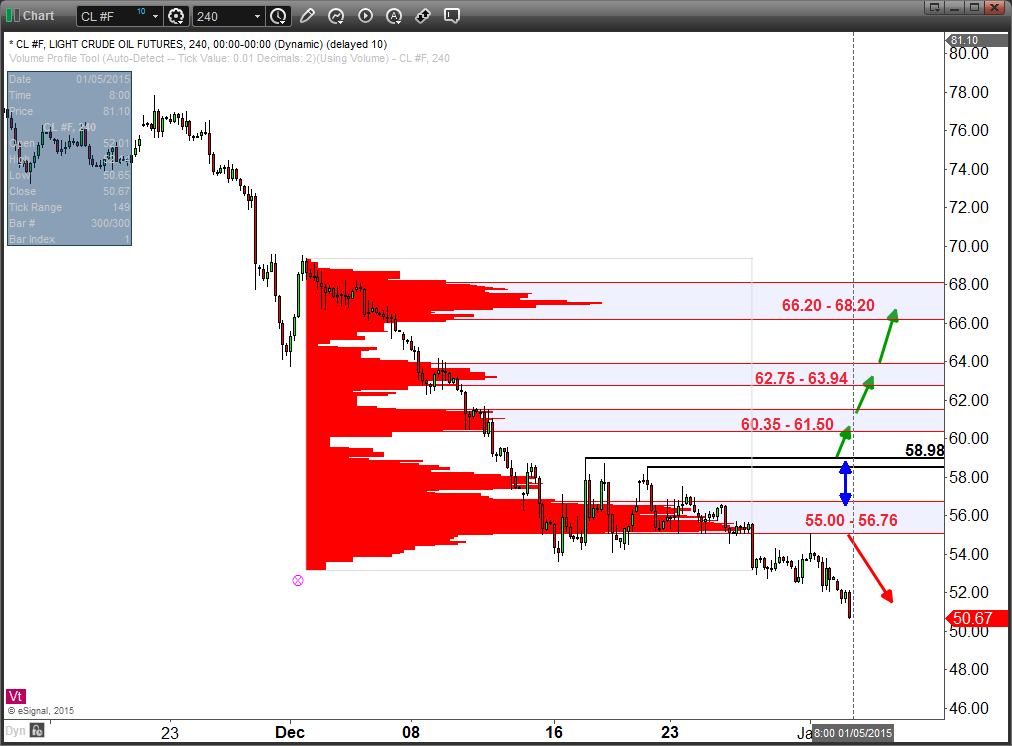

Using the perspective that comes from viewing volume-at-price information, we can answer this question. As you can see from the chart below, the most recent consolidation built a high-volume area at 55.00 – 56.76. For a time, this was a price where buyers and sellers were transacting and where value was established.

The continuation lower suggests that price is seeking a new area where both buyers and sellers can agree on the future price of a barrel of oil.

At some point, prices will move up to test and then exceed one of these high-volume areas that are being built as we head lower. This is the first (and required) indication the buyers and sellers in this market are agreeing that lower areas of prior value are too low.

Until price can move above one of these areas, the trend toward lower prices and lower values remains in force. And while the trend lower remains in force, trying to guess the bottom is a fool’s errand.

If you would like to see more research and analysis from i10 Research, please click here.