By: Pej Hamidi

We are still in Long/Short nirvana, with a stock picker’s market. Things are getting a bit tricky with volatility rising, but a little volatility is good right about here. The patient trader will be rewarded and the name of the game is “banking profits.” Book those gains and don’t give them back just because you’re sitting in front of your screens and bored. That’s terrible discipline.

A big upside gap in Gold prices (GLD) on Tuesday looks set to follow-through as I write this on Wednesday afternoon. Pressure on the U.S. Dollar, an uptick in energy prices, a noticeable increase in equity volatility and put premiums suggests that the market is behaving defensively. I included a chart of GLD, which shows the gap taking prices outside of the short-term downtrend. Also, note the divergence between prices and the indicators above. During this retracement, the positive divergence in money-flow and momentum are glaring out at you. Tuesday’s gap was accompanied by good volume, causing a sharp acceleration in the diverging indicators. Click on the chart below for a closer look.

I see a rotation into specific solar names. One can’t trade the solar sector all “willy nilly,” as Sperls would say. You have to know what each company does and where they fit on the food chain. For example, I’ve included charts of Canadian Solar (CSIQ) and Trina Solar (TSL). These two are exploiting the global oversupply of silicon wafers to expand at the module and cell level.

CSIQ:

TSL:

Solar stocks have sold off sharply with the broader market presenting an opportunity to buy emerging leaders. Conversely, for fundamental reasons pertaining to where First Solar sits on that food chain, FSLR has become the hedgies favorite stock to sell hard on rallies, which generally are short squeezes.

With FSLR being another “Beta Monster,” if one is long CSIQ and TSL, just a couple hundred shares short FSLR against long several thousand CSIQ and TSL would work, and if you trade around the positions to take advantage of micro-movements, a sharp trader can carve out quite a bit of Alpha. Overhead resistance is $132 for FSLR, which is where one could start building a short line.

Although I’m long-term very bullish on big-cap tech, in the short-term, I’m bearish on Google (GOOG). Her failure to capture any analyst attention with Android’s V.2 release is one of the main reasons Google has taken a technical pounding ($110/17%) in the last month.

If you look at the chart I posted, selling pressure leveled off at the 23.6% fib retracement line. Overhead resistance is heavy around $560 and if this base is broken, it’s a quick shot to the 200d-EMA at $510 then $500. The next fib retrace (38.2%) is at $485. GOOG is another “Beta Monster” and certainly not for the timid. The bracket to watch is $520 to $560. Trade a “Mean-Reversion” strategy between those two levels until a break in either direction. My concern is the downside gap on January 22nd. It looks to me to be a continuation or breakaway gap, suggesting an equidistant move from the January 4th high of $630. That’s at least another $50 or so depending on which level you use on January 21 (the day prior to the gap).

If you look at the chart I posted, selling pressure leveled off at the 23.6% fib retracement line. Overhead resistance is heavy around $560 and if this base is broken, it’s a quick shot to the 200d-EMA at $510 then $500. The next fib retrace (38.2%) is at $485. GOOG is another “Beta Monster” and certainly not for the timid. The bracket to watch is $520 to $560. Trade a “Mean-Reversion” strategy between those two levels until a break in either direction. My concern is the downside gap on January 22nd. It looks to me to be a continuation or breakaway gap, suggesting an equidistant move from the January 4th high of $630. That’s at least another $50 or so depending on which level you use on January 21 (the day prior to the gap).

On the other hand, Apple (AAPL) has held up against Google’s assault on its flank, instead spinning the PR machine to look ahead at the pending release of Apple’s Tablet Computer–the iPad. Until the release of the tablet though, AAPL will remain range-bound between $195 and $215. The trade remains the same here in AAPL in between those ranges. Open a long position in the last 30 minutes, to sell into an opening gap the next day.

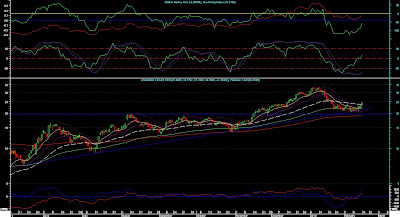

Lastly, Wynn Resorts (WYNN) looks like a good long-term position to accumulate. The chart I’ve included shows the massive reverse head and shoulders bottom and sideways consolidation while all the moving averages converge underneath.

A decisive break above $65 or any weakness to $60 are good reasons to get long. Yes, Las Vegas is a mess with a crumbling real estate sector and massive job losses, but Wynn is dominating the Macau market, where it continues to grab a larger share of the “whales”. And, Macau is exploding as a gamblers Mecca (pun intended).