The S&P’s have been flagging right below the highs of the year. Yesterday, we traded to the top of the recent three-day range before pulling off and closing near the bottom end. This morning, the S&P is opening up today at 1333-1335. If we get a 60 minute close above this level, the market should soon make an attempt to take out the 1343 highs. While ranges have been tight in the market over the past few days, sector rotation has been rampant as many stocks have made explosive moves. We have been watching stocks that held up best during the correction. This is why we embrace pull-backs; they highlight relative strength and introduce new leaders to the market.

Back in 2008 on CNBC, Scott Redler told Marc Haines that gold, which was then priced around $850/ounce, could eventually hit $1500. Dennis Gartman said that if that happens, Scott Redler doesn’t “believe in the American way of life”. Well, we are getting close the that lofty target with yesterday’s latest breakout. The SPDR Gold Trust ETF (GLD) is set to continue to the upside at the open this morning. However, the big story yesterday were the gold mining stocks, which in a rare turn handily outperformed the underlying commodity. The Market Vectors Gold Miners ETF (GDX) surged 5% yesterday and is up another 0.6% this morning. Later in this article we will cover the mining stocks more in-depth.

For more market and stock commentary, watch the T3Live.com Morning Call with Scott Redler and Alix Steel below.

Tech

Tech has once again emerged as one of the leaders of this rally. New-age Chinese stocks SINA Corporation (SINA), Sohu.com, Inc. (SOHU), Baidu.com, Inc. (BIDU)and NetEase.com, Inc. (NTES) have been among the strongest stocks in the market. Travelzoo Inc. (TZOO) has been on a tremendous run higher. Amazon.com, Inc. (AMZN) was in the doghouse but is making its way quickly back toward highs on cloud computing developments at the company. However, most of these stocks are extended at this point in time, but buyable on pullbacks. We will continue to follow them closely on the Virtual Trading Floor.

Apple Inc. (AAPL), the perennial tech leader, has been one of the weakest in the group, but looks to be working off the weight several negative headlines. Steve Jobs’ health and status with the company remains the biggest question mark. Supply chain concerns for Apple in Japan also weighed on the stock for a period. Most recently, a rebalancing of the major indices, in which Apple’s component percentage was trimmed, forced some holders of the stock to sell, forcing yesterday’s gap down. However, AAPL seemed to take all that news in stride and should get back to highs at some point. It’s slow right now, but at its current share price is drastically undervalued.

Apparel

Another group that has seen great tradable moves over the past few days are the apparel stocks. Hot yoga apparel maker Lululemon Athletica, inc. (LULU), athletic apparel maker Under Armour, Inc. (UA), Polo Ralph Lauren Corporation (RL) all had nice breakouts, but are likewise a bit extended and need time. UA and LULU provide the most momentum, and have been extremely resilient. All three of these were covered in the Morning Call over the last week or so, and we will watch them closely on pullbacks.

Oil Service

Yesterday we saw precious metal-related stocks provide big moves, while oil stocks continue to rest. In keeping with the sector rotation theme, it could be the Oil Service HOLDRs ETF (OIH) turn to breakout. Most stocks in the group have based nicely near highs, looking poised to explode to highs. The ETFs largest component, Schlumberger Limited (SLB) is in the bottom end of its flag, but would be a good buy above $94.50-95.50, likewise with Halliburton Company (HAL) above $50.75. Marc Sperling this morning chose Apache Corporation (APA) as his pick of the litter as it has behaved the strongest.

Precious Metal Stocks

Now, to gold stocks. During almost every stage of this long bull run in precious metals, silver has outperformed gold. While the iShares Silver Trust ETF (SLV) did gain more than the SPDR Gold Trust ETF (GLD) yesterday, the big story was gold mining stocks. Silver mining stocks were also strong, but trumped by their yellow counterparts. Let’s take a look at a list of gold mining stocks and see which ones can see some follow-through:

Goldcorp Inc. (GG) is the group leader at new highs, gaining 6% yesterday. You might want to look elsewhere today as this one is a little extended.

Barrick Gold Corp. (ABX) is among the largest in this group, and although it had an equally large move yesterday it remains below pivot highs. It could be the next to break out. You can possibly look to add above $54.36 and then it should take out highs of $55.72.

NovaGold Resources Inc. (NG) is a smaller company, and had a big 7% move yesterday, but also remains well below pivot highs. Redler bought NG yesterday, and will look to add at $13.80, expecting to see it hit $15 quickly then highs at some point.

Yamana Gold Inc. (AUY) is another smaller guy but also sits below highs. Redler is also long AUY and will look to add above $13 for the breakout.

Randgold Resources Ltd. (GOLD) has been the group dog over the past several months, but was one of the biggest gainers yesterday at 7.7%. It could have plenty of more juice. Newmont Mining Corporation (NEM) looks similar.

We can’t forget about silver, either, which extended again after opening at new highs yesterday. The two main foci in the silver mining group for T3Live contributors have been Coeurd’Alene Mines Corporation (CDE) and Silver Wheaton Corp. (SLW). CDE was the one to breakout yesterday, gaining 5.34% and blasting off above highs. SLW is lagging a bit and just coming up to high. SLW is more compelling at this point and could gain more steam above $46-46.50.

Opticals

Optical stocks got another blow yesterday after Oclaro, Inc. (OCLR) pre-announced weaker than expected guidance. It’s the latest blow after a poor report from Finisar Corporation (FNSR) sent the group plummeting several weeks ago. At this point all the bad news in the sector should be priced in, and we will be looking at the stocks for an oversold bounce. The best stock in the group is JDS Uniphase Corporation (JDSU).

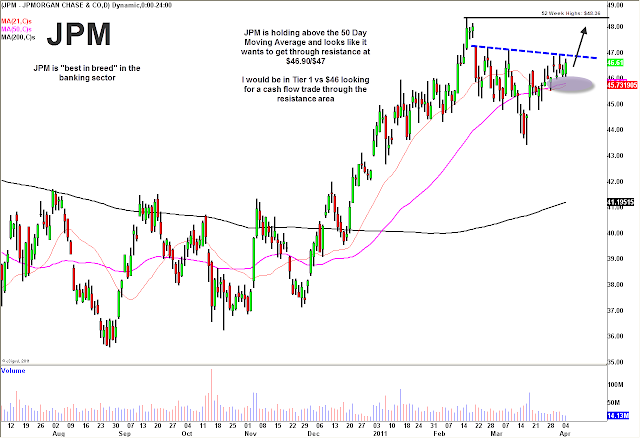

Banks

Finally, Redler believes now may be the time for the laggard play in the banks. The sector has been among the weakest in the market, so it’s not prudent to trade anything but the clear leader at this point, which is JP Morgan Chase & Co. (JPM). Redler is currently long, and will look to add if it can get above $46.90 and hold.

*DISCLOSURE: Scott Redler is long LVS, APL, XOM, AUY, NG, GLD, ABX, FCX, JPM, F, V, BAC, OIH, LMT, RBY, SSYS, MSFT. Short SPY. Marc Sperling is long SLV.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.