Now, like many Americans, the Democrats know what it’s like to lose their House.

Now, like many Americans, the Democrats know what it’s like to lose their House.

Back in the mid-1800′s, the nation had another kind of Tea Party as the Whigs became a successful 3rd party, even going so far as to put two men in the White House – William Henry Harrison and Zachary Taylor plus Millard Fillmore, who succeeded “Old Rough and Ready” who died just after a year in office but that was a long term compared to Harrison, who caught pneumonia making a long inauguration speech in the freezing rain and died of it a month later despite attempts to cure him with opium, castor oil and leeches – treatments we are likely to see again as the Republicans vow to repeal Health Care legislation.

I don’t have to talk about what happened last night, Barry Ritholtz did a great job of it in “The Tragedy of the Obama Administration” so let’s just focus on the repercussions of the changeover and, of course, today’s upcoming Fed decision. The Board of Governors were meeting all day yesterday and will meet again this morning to discuss their policy decision and one would think they can’t be so deaf as to see that our citizens are not interested in additional deficit spending, which is exactly what QE2 is when the Fed writes checks to paper over the Treasury’s profligate spending.

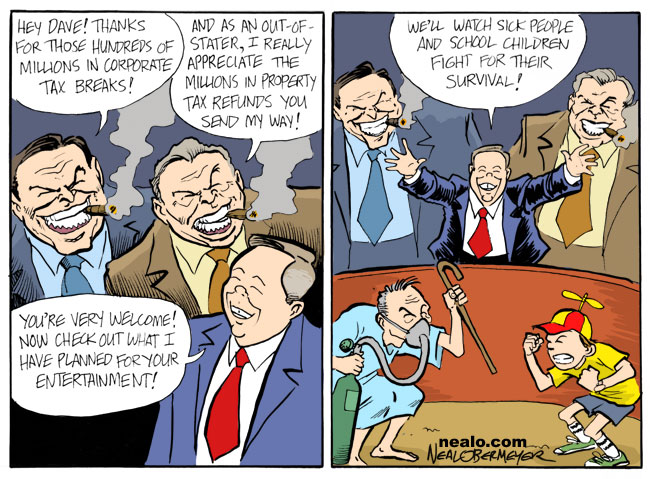

Look for new and improved ways of not taxing corporations. Like GM, which will not have to pay taxes on its next $45.4Bn of earnings despite the fact that the Government paid for their losses already and allowed the company to bust union contracts and trash benefits for the millions of retired and fired workers as they shut down and sold brands – permanently shipping US manufacturing jobs overseas.

Look for new and improved ways of not taxing corporations. Like GM, which will not have to pay taxes on its next $45.4Bn of earnings despite the fact that the Government paid for their losses already and allowed the company to bust union contracts and trash benefits for the millions of retired and fired workers as they shut down and sold brands – permanently shipping US manufacturing jobs overseas.

Of course, this tax break isn’t about GM. GM just sets a good precedent for similar treatment of Banksters and others who received relief under TARP and, of course, whatever they decide to call the next emergency bailout of Big Business. If the market breaks our tops, we are going to be loving the XLF which already owns most of the people who got elected last night. With FAS at $22.44, we can sell the April $19 puts for $2.75 and buy the Jan $17/21.67 bull call spread for $3.10 and that’s net .35 on the $4.67…