Well, you can’t say I didn’t tell you so…

Well, you can’t say I didn’t tell you so…

Yesterday’s post was all about what total nonsense the move up was and, per usual, the whole thing was taken away in the futures, where retail investorst have no chance to profit from it. Of course, this market isn’t being run for your benefit and if you wait for Cramer to tell you what to do, then you are pretty screwed (and more so if you listen to him). Yesterday our boy Jim fell off the wagon and declared victory for the Bulls saying: “Thebears must be stunned andconfused, flummoxed even” and made fun of those of us who worry about “facts” and “fundamentals” as we trade. “Every argument the bears had for selling,” Cramer said, “has been totally rebuffed by this great market.” Cramer, you are not just an idiot, you are a dangerous idiot!

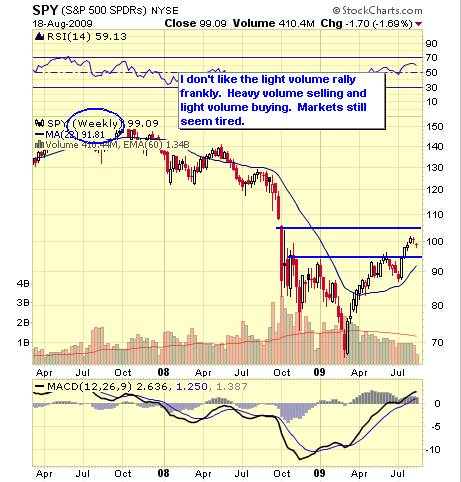

As the more rationalDavid Fry points out in his “Spin City” post:

So we got a healthy bounce today but it didn’t undo Friday and Monday’s collective damage. We were a little short-term oversold and a bounce shouldn’t surprise even though economic and company news wasn’t great. But, the “better than expected” spin was in for retailers which frankly was laughable. And, golly, banks reported losses on credit cards were slowing (maybe because Chucky’s not shopping?) which was seen as a positive. Homebuilders disappointed (oops, scratch that)… a “worse than expected” report was spun positively because more single family homes were built. I wonder about that since there are too many of them, aren’t there? But that’s the way things are these days.

What a stark contrast between a sane and insane take on yesterday’s action. In Monday’s post we targeted a drop toDow 9,100, S&P 980, Nasdaq 1,950, NYSE 6,400 and Russell 550and in my 9:48 Alert to Members yesterday I set the bounce targets atDow 9,200, S&P 986, Nas 1,946, NYSE 6,400 and RUT 555but noting theywere rough numbers that I was eyeballing on the fly, following our 5% rule. Those levels were beat across the board but on such low volume that I called an audible and we stayed bearish, taking aggressive short positions like the DIA Aug $93 puts at $1.50 which, unfortunately, didn’t make our double down target of $1 but should do well this morning. We also took short shots at COF, HPQ (backspread), RTP (looking very good this morning!), SRS (our old friend), RTHand…

What a stark contrast between a sane and insane take on yesterday’s action. In Monday’s post we targeted a drop toDow 9,100, S&P 980, Nasdaq 1,950, NYSE 6,400 and Russell 550and in my 9:48 Alert to Members yesterday I set the bounce targets atDow 9,200, S&P 986, Nas 1,946, NYSE 6,400 and RUT 555but noting theywere rough numbers that I was eyeballing on the fly, following our 5% rule. Those levels were beat across the board but on such low volume that I called an audible and we stayed bearish, taking aggressive short positions like the DIA Aug $93 puts at $1.50 which, unfortunately, didn’t make our double down target of $1 but should do well this morning. We also took short shots at COF, HPQ (backspread), RTP (looking very good this morning!), SRS (our old friend), RTHand…