This blog is published by Andy Waldock. Andy Waldock is a trader, analyst, broker and asset manager. Therefore, Andy Waldock may have positions for himself, his family, or, his clients in any market discussed. The blog is meant for educational purposes and to develop a dialogue among those with an interest in the commodity markets. The commodity markets employ a high degree of leverage and may not be suitable for all investors. There is substantial risk in investing in futures.

This morning, (11/9/09) the U.S. Dollar is significantly lower and testing the ’08 lows. Gold is making new highs and holding over $1000 per ounce and crude is up $1.60. This is as it should be in a Dollar devaluing world, global assets priced in Dollars should climb in response to its decline. Economics 101 tells us that there is a negative correlation between global asset price and the price of the Dollar.

So far so good, right? Not so much. Every weekend, I download the Commitment of Traders Reports to see what the different categories of traders are doing. The three main categories I track are the commercial traders, the small speculators and the funds. As many of you know, a big portion of my trading is based on the momentum of the commercial traders’ actions. There are three main reasons for this. First, they understand the fundamentals of the markets they trade – their markets are their business. Second, as the fundamental players in the business of their markets, they have a vested bottom line interest in pricing their products profitably.

Finally, when they act collectively, based on their fundamental knowledge of their markets, they have the resources to move markets. Therefore, when they move, I want to be on their side.

Typically, the commercial positions rise and fall with the ebb and flow of the markets. They may act within the channel boundaries of a trending market or, they may be trading against support and resistance in sideways markets but, typically, they use their fundamental knowledge to pick the right side for the coming period of time.

Occasionally, we see these relationships pushed to the extreme and this is one of those times. I’ve selected three markets to illustrate this point – Gold, Crude Oil and the U.S. Dollar. As the Dollar has declined over this past year, we’ve witnessed a steady building of commercial long positions with a net accumulation of approximately 20, 000 contracts.

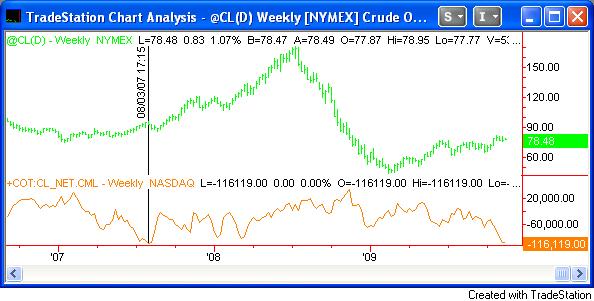

Crude oil has seen commercial net short positions increase by more than 100,000 contracts since July. This also places Crude at a new net short record, eclipsing the August of 2007 mark.

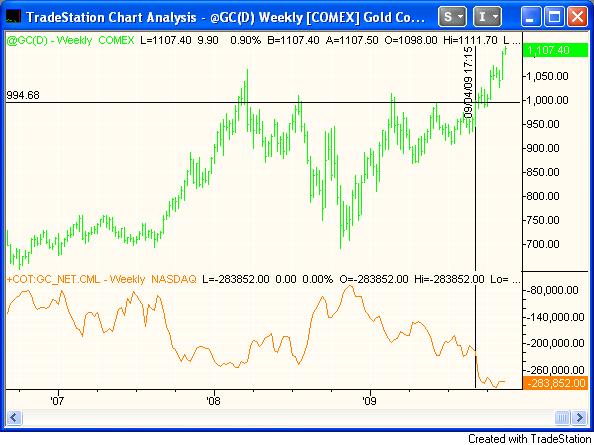

Finally, we have the Gold market. It’s been in the news everyday. Beginning in September, we can see that once the market started to breakout above the $990 level, commercial traders began to increase the pace of their selling. They have increased their net short positions by more than 30%.

The final point to make is that people on the other sides of these trades are just that, people. Remember that it takes both a buyer and a seller to create a trade. The commercial entities need someone to take the other side of their trades. Those someones are the small speculators and the commodity funds. The commodity funds will always maintain a certain percentage of their assets in a given market. They adjust their asset base according to price, adding to their positions as prices rise and paring back their positions as the markets fall. Most importantly, they position themselves from the LONG SIDE ONLY. The small speculators can and do, trade both sides of the market and they are typically long at the top and short at the bottom. So, if the commercials have accumulated large, in some cases historical, positions that are opposite the markets’ current direction, who do you think is on the other side of their trades with historically sized positions betting on the trend to continue?

These are interesting times with the elastic band of the markets stretched to historical proportions. As a trader, I’m never one to bet my money against a trend’s continuation as my bottom line is only effected by the last traded price. Markets can remain irrational far longer than I can hold a bet against them. However, it would behoove those participants on the side of the small speculators to tighten up their protective stops as a reversal of fortune could send a record number of players heading for the exits.