On February 3rd, Ford Motor reported U.S. January consumer sales jumped 15.3% on a year-over-year basis to 178,351 units (truck sales +23%). The new aluminum F-150 trucks are making up 18% of the category (it was 5% in December) with turnover at just 12 days. They expect full availability of the next generation of trucks in late Q2 for U.S. consumers. Other improvements included Mustang sales at their highest since 2007 and Lincoln sales since 2010 (+10.8% from January 2014). Overall for the industry, the seasonally adjusted annualized selling rate (SAAR) rose to 16.7M vs 15.29M last January, according to Automotive News.

Shares of Ford trade at a P/E ratio of 10.12x (2015 estimates) with 37.1% EPS growth, price to sales ratio of 0.43x, and a price to book ratio of 2.37x. Top line growth is likely to stay in the mid-single digits for the next couple of years, hitting $150B in sales in 2016.

The company did report Q4 revenue of $33.8B vs. the Wall Street estimate of $34.43B on January 29th, but the automotive company topped earnings estimates by $0.03, or $0.26 per share (marked the 11th EPS beat in 12 quarters). Their U.S. market share stood at 14.3% at the end of the fiscal year.

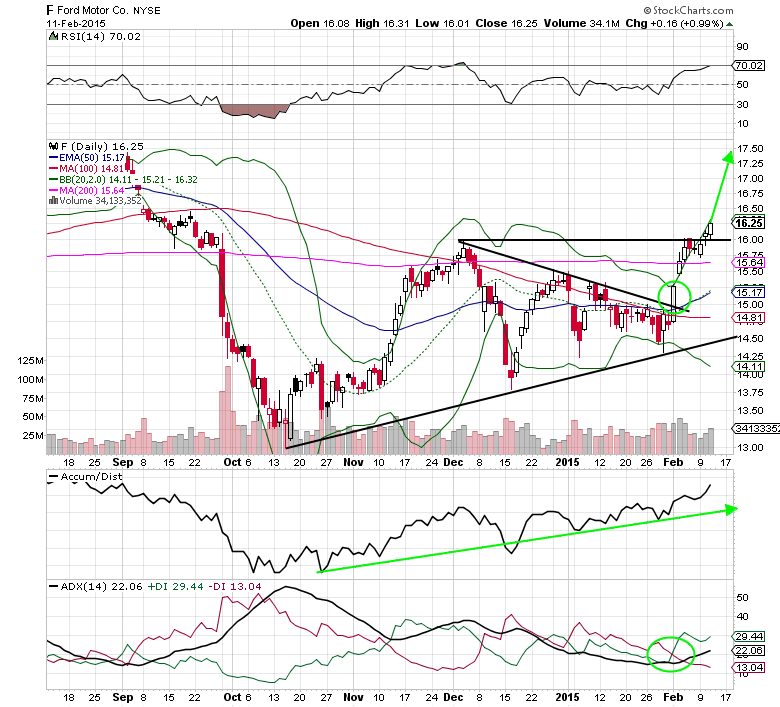

Looking at the 6-month daily chart above, we can see that the stock finally broke out above the $16 resistance level from early December on February 10th. This breakout sets up for a return to the mid $17’s (resistance from July and August) on a measured-move basis in the coming months. The uptrend in the accumulation/distribution line and the crossover in the ADX line (w/+DI and –DI) confirm the bullish price action.

Ford Motor Options Trade Idea

- Buy the Mar 20 $15 call for $1.35 or better

- Stop loss- $0.65

- 1st upside target- $2.00

- 2nd upside target- $2.50

Implied volatility is near the lower end of the range in Ford options, so there is no need to do a more complex strategy such as a call butterfly to lower the cost. These 15 strike calls have a delta of 0.85 and a very low theta of -0.0036. If you purchase these calls at $1.35, then your breakeven point is $16.35 (less than 1% away in the stock price).

*** Disclosure: I’m long the (F) Mar 20 $15 calls for $1.26 each.

#####

To get Mitchell’s Unusual Options Activity Report featuring Ziopharm Oncology (ZIOP), please click here.