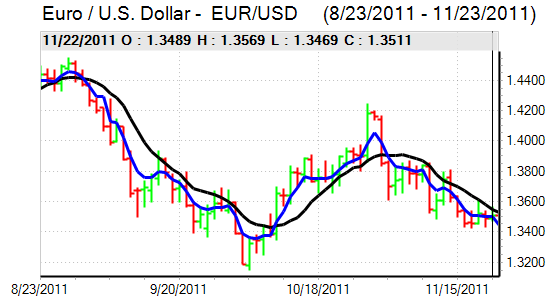

EUR/USD

The Euro gained temporary support from the German IFO business confidence survey on Thursday which recorded a rise to 106.6 for November from 106.4 the previous month, contrary to expectations of a further monthly decline. There were also some reassuring comments from the Institute, although sentiment remained extremely fragile as fears over a deflationary spiral increased.

The currency was unable to gain sustained relief as wider Euro-zone tensions quickly regained pre-dominance. Equity markets were unable to gain support as underlying confidence continued to deteriorate with peripheral bond yields rising again and there was also a further sharp rise in Belgian yields as Dexia was forced to tap emergency funding. There was a further increase in fear surrounding the banking sector as a whole amid speculation over a further tightening in liquidity as banks remained shut-out of wholesale markets.

There was a further increase in dollar Libor rates and evidence of further important stresses within the banking sector as liquidity continued to deteriorate with banks forced to respond to a withdrawal of funds. Portugal’s credit rating was cut again by Fitch while the Troika would return to Greece on December 12th for negotiations surrounding the next loan tranche and second rescue package.

There was a meeting between German Chancellor Merkel, French President Sarkozy and Italian Prime Minister Monti. The main focus was on the issue of Eurobonds and Merkel again voiced strong opposition stating that they would give the wrong signal to the markets. The hard-line rhetoric increased fears surrounding the Euro-zone which intensified the deterioration in risk appetite and there was also increased pressure for further ECB action which undermined the Euro.

There was very little US influence given the Thanksgiving Holiday and the Euro dipped to lows near 1.33 as liquidity fell and confidence surrounding the Euro area continued to deteriorate.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to the 77 level against the US currency on Thursday and pushed to highs in the 77.50 area where the currency again hit tough resistance. The Euro found some support blow 103, but was unable to make significant headway.

Japanese Finance Minister Azumi warned that there would be a decisive response to speculative currency moves which had some impact in curbing yen support.

There was still evidence of capital inflows into the currency with a net buying of Japanese bonds rising to US$220bn this year. There will be the risk of further capita repatriation flows from the Euro-zone which will also help support the currency.

Sterling

Sterling was unable to gain any significant traction during Thursday and retreated to test 7-week lows following a break of support in the 1.55 area against the US dollar with Sterling also unable to make much ground against the Euro.

The revised third-quarter GDP growth estimate was steady at 0.5%, but the figure relied more on a build-up of inventories which increased fears that there would be weaker data for the fourth quarter. The latest CBI industrial survey was also weak with a figure of -19 from -18 previously as export orders declined sharply.

There were further downbeat comments from Bank of England officials with Miles warning over the recession risk and the UK currency was also unsettled by a further deterioration in risk appetite. The UK currency was unable to gain sustained relief and dipped to lows near 1.5455 against the dollar despite the potential for further defensive inflows.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

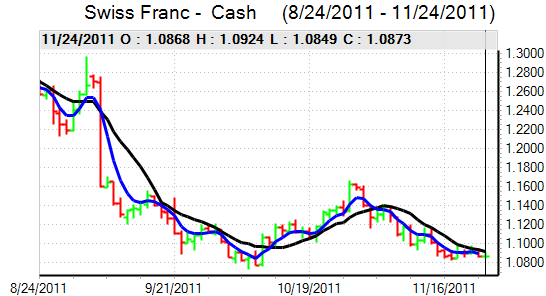

Swiss franc

There was further choppy franc trading on Thursday, amplified by a lack of liquidity. There was strong support on dips to the 0.9150 area and the US currency pushed to highs near 0.9220 in Asian trading on Friday. The Euro was unable to gain any traction against the Euro and again dipped to lows near 1.2250, although markets remained concerned over the risk of intervention.

There were increased fears surrounding the Euro-zone banking sector which could lead to inflows into the Swiss banking sector, although there will also be unease surrounding the domestic banks and there will be the threat of further instability which will also trigger the potential for higher franc volatility.

Australian dollar

The Australian dollar attempted a corrective recovery during Thursday, but it was unable to make any sustained progress with a peak below the 0.98 level against the US currency and there was a fresh retreat to lows below the 0.97 level in Asian trading on Friday, the eighth successive daily decline.

There were further concerns surrounding risk appetite which undermined confidence in the Australian currency as equity markets remained on the defensive and fears surrounding the regional economy increased. There was a warning by the Reserve Bank over the dangers to the local banking sector if global liquidity continues to deteriorate and this contributed to the negative mood surrounding the Australian dollar.