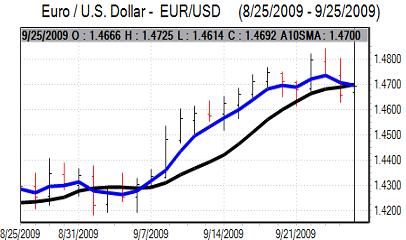

EUR/USD

The Euro drifted slightly weaker in Asian trading on Monday, although ranges were narrow and the currency remained broadly resilient during the day.

The European financial sector remained an important influence during the day, especially with a lack of key economic data during the day. There was a particular focus on Ireland with Moody’s downgrading the credit rating of Allied Irish Bank by three notches. There were also increased fears surrounding the bank’s debt situation and there were reports that the total cost to the government of supporting the bank could push the budget deficit to at least 20% of GDP which would create further major stresses on the government finances.

There were wider fears over the Euro-zone financial sector, although there was no further significant widening in credit-default swaps during the day. There was also some nervousness ahead of the ECB liquidity tenders due later this week as the Euro dipped ahead of the previous auction. The Euro retreated to lows around 1.3420 before recovering and attempting to break resistance close to 1.35.

There were no major US economic data releases while 2 regional PMI surveys suggesting a further deterioration in manufacturing conditions. There will be further speculation that the Federal Reserve will sanction further quantitative easing within the next few months and the lack of yield support remained an important negative factor for the dollar. The Euro failed to break above 1.35 and consolidated close to 1.3450.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The Japanese economic releases did not have a significant impact on Monday with the trade surplus slightly weaker than expected. There was evidence of yen demand ahead of the end of fiscal half-year later this week. A number of investment trusts are due to launch this week and heavy demand could curb yen demand, although there will be uncertainty over the strength of investor demand given unease over the global economy.

There was no evidence of direct intervention on Monday and the dollar remained pinned near the 84.20 area with markets reluctant to sell the US currency aggressively given the persistent intervention threat.

The dollar was still unable to secure any significant buying support and weakened to lows close to 84.10, the lowest since the original Bank of Japan intervention earlier in September.

Sterling

The Hometrack organisation reported that UK house prices fell again in September, although the impact was limited following recent downbeat housing-sector data with markets already pricing in a significant deterioration. Caution is still required as there could be a further important decline in confidence surrounding the economy within the next few weeks.

In its latest report, the IMF was broadly supportive of the coalition government’s stance to tighten fiscal policy substantially. It described the reductions as essential and the IMF remarks were significant in maintaining Sterling confidence during the day as structural fears eased.

The latest PMI data will be watched closely on Friday as any further substantial deterioration would pose very important risks to confidence surrounding the economy and Sterling.

Confidence remained firm for now and the UK currency pushed to a 7-week high above 1.5850 against the dollar before consolidating just below this level.

Swiss franc

The dollar found some support close to 0.98 against the franc on Monday, but rallies were severely constrained by the underlying lack of confidence in the US currency. The Euro edged stronger to near 1.33 before hitting profit taking.

There were further reports that Eastern European banks were closing mortgages denominated in the Swiss franc, especially with evidence that bad loans were still increasing and this was an important factor in providing underlying franc support during the session. The Swiss currency also drew some support from continuing unease over the Euro-zone financial sector.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

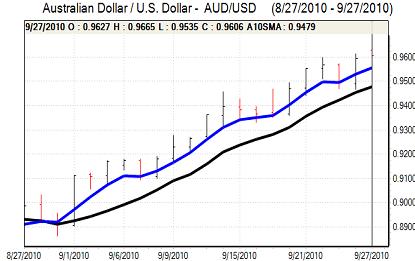

Australian dollar

The Australian dollar maintained a firm tone in local trading on Monday with a move to above the 0.96 level against the US dollar and there was a further two-year peak above 0.9630 later in the US session.

There was further underlying yield support for the Australian currency during the day and the currency also drew default support from a persistent lack of confidence in the US and Euro-zone outlook. With markets still on alert over the possibility of a move to parity, there was solid buying support on any significant retreat for the currency.