We are off to the races today!

We are off to the races today!

Too bad I’m going to miss this, I’m away for the day but have fun on what is probably going to be the lowest-volume day since our top in mid-October. Let’s call this a bonus rally as market pushers take advantage of the low, Veteran’s Day volume and lack of substantive news to goose us over our 5% levels, which will now give us some critical bullish lines to hold.

Yesterday I said we would be looking for retraces before breaking higher and clearly we are not getting them as the market is up almost a full point in pre-market trading as the Dollar falls below 90 Yen and now a full $1.50 is needed to buy a Euro, up from $1.25 (20%) in March. Does it bother you that your bank account has lost 20% of it’s buying power compared to the rest of the civilized World in just 8 months? Does it bother you that your wages (if you are one of the 89% that are not already unemployed) have lost 20% of their buying power? If you are the average American citizen – Not at all! No one seems to care and it’s too complicated for the MSM to explain because it requires math.

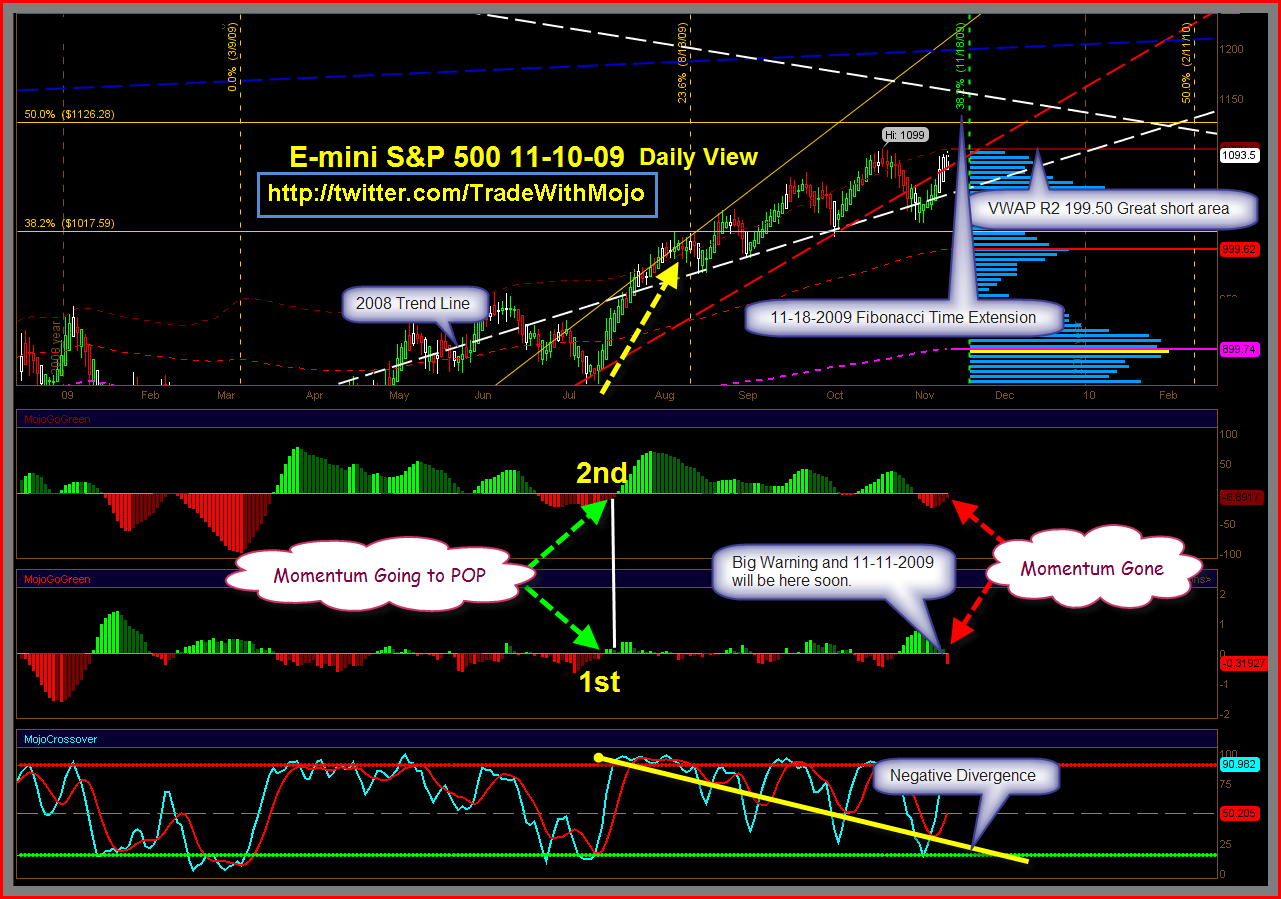

We are still too bearish (55%) for a move over our range tops as I underestimated the ability of the pumpers to stir enough excitement on low volume to get us over the 5% lines we discussed in yesterday’s post (Dow 10,206, S&P 1,086, Nas 2,152, NYSE 7,087 and Russell 588) let alone the 25% upside levels we targeted in Monday’s post (Dow 10,250, S&P 1,100, Nasdaq 2,187, NYSE 7,000 and Russell 600) – which is where we planned on getting more bullish. Will we hold it? That’s the question of the day and, even if we do hold it today on low volume – it won’t matter until we get a proper test. As you can see from Mojo’s S&P chart, we are now into our bonus round of upward movement that may last until next Wednesday but, more likely than not, 1,100 is a great shorting opportunity on the S&P this morning.

I wrote an article earlier about the Global Oil Scam and the same techniques that are used to manipulate the energy markets are in play today. We are hearing a ton of analyst upgrades this morning, including poppa Goldman telling the sheeple that gold can go…