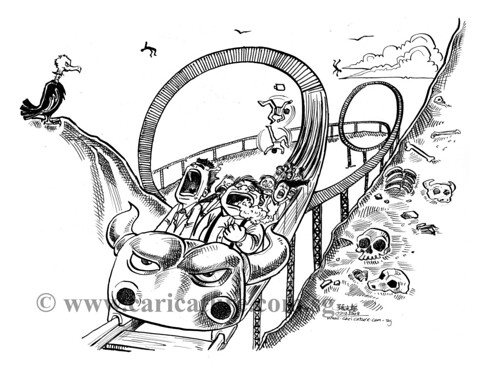

Wow, what a ride!

Wow, what a ride!

As I mentioned in yesterday’s post, we expected the Russell to lead us higher and we picked up both IWM and TNA out of the gate but, of course, we like our leverage so my 9:46 Alert to Members was:

Bottoms WERE: Dow 10,200, S&P 1,075, Nas 2,200, NYSE 6,800 and Russell 620. As I said yesterday, “don’t forget there’s a 5% drop to support below these levels).

For now, we’ll be watching the 2.5% lines at Dow 9,945, S&P 1,048, S&P 1,145, NYSE 6,630 and Russell 605.

My working theory is RUT is weakest because they are getting killed by cut-off of unemployment checks. That means that an upside play on the RUT could go very well in case they extend benefits today. I like TNA $37 calls for $3.20 and IWM $63 calls at $1.25. These are risky of course because if the extension is defeated we could go further down so take quick profits off the table on half to make a buffer and make sure you do have some disaster hedges.

We bounced right off those 2.5% lines and got our $3 copper signal at 10:24 so we knew we were good to go as we took those calls plus GOOG, BAC, GS, QQQQ, IBM, TXN, AAPL, WFR and BIIB. Other than BIIB, which is a long-term spread, all of our shopping was done by noon and the rest of the day we just said “Wheeeeeeeeeeeeeee!” as the market went up and up and up – and they haven’t even extended the unemployment benefits yet!

I have been saying we need to keep an eye on copper $3 during this whole market breakdown as $3 copper is NOT the right price for a Global Depression, which is what the market has been pricing in and at 10:24 as copper hit our bull target, I said to Members: “Copper $3! That’s like the little snapping sound when the bear takes the bait in the bear trap.” Now we are back testing our “bottoms” which, as I said yesterday, are really the middles of our 5% Rule range but our view of earnings season so far is that we shouldn’t be in the lower end of the range and the recent action, as I summed it up in yesterday’s post, was silly.

Now things get serious as we need to hold our levels or it will be time to take…

Now things get serious as we need to hold our levels or it will be time to take…